Abstract

The present study explores some marketing mix effects on private labels brand equity creation. The research aims to study the effect of some elements under retailers direct control such as in-store communications, in-store promotions and distribution intensity as well as other general marketing mix levers such as advertising, perceived price, and monetary promotions. The results indicate that the most efficient marketing mix tools for private label brand equity creation are private labels in-store communications, private labels distribution intensity and the perceived price. These results highlight the importance of the store as a key driver for the private labels brand equity creation. As opposed to manufacturer brands we find no effect of advertising on the private labels brand equity and an opposite effect of the perceived price. This study is a pioneering contribution in the domain of private labels brand equity research exploring a more comprehensive and in-store specific set of marketing mix initiatives as sources of brand equity. The results suggest important implications for retailers when managing their own brands.

JEL classification

M31;M37

Keywords

Private labels;Store brands;Brand equity;In-store communication;Distribution

Introduction

Private label brands, also known as “store brands” or “distributor brands”, were considered low-price, low-quality products several decades ago; currently, however, they represent a clear alternative to manufacturer brands (Kapferer, 2008). They account for more than 40% of the market in six European countries (Private Label Manufacturers Association [PLMA], 2015). In general, private labels refer to brands owned by the retailer or distributor and sold only in its own stores (Kumar & Steenkamp, 2007). Conversely, manufacturer brands are brands owned by manufacturers with the purpose of commercializing them.

One determinant of a private labels success is the concentration of the retailing industry (Hoch & Banerji, 1993). This concentration has implications for manufacturer brands and private label dynamics: First, retailers can grow larger because they can achieve economies of scale by offering similar products at lower prices (Dhar & Hoch, 1997). Second, a retailers critical mass allows it to find powerful suppliers to manufacture its private labels, thereby ensuring good quality.

The development of private labels has resulted in many advantages for retailers. For example, they can serve as strategic tools to enhance differentiation and positioning between retailers (Grewal et al., 1998; Richardson et al., 1996; Semeijn et al., 2004 ; Sudhir and Talukdar, 2004). They can also build store loyalty, strong consumer relationships and store image (Bigné et al., 2013; Bonfrer and Chintagunta, 2004; Collins-Dodd and Lindley, 2003; Corstjens and Lal, 2000; Miquel-Romero et al., 2014 ; Richardson et al., 1996). However, managing private labels is unquestionably a challenge for retailers (Wu, Yeh, & Hsiao, 2011), whose main business traditionally has been distribution of products. Retailers must be aware of the strategic role of their private labels and develop strong investments and efforts to build their private label brand equity (Burt, 2000 ; Dekimpe and Steenkamp, 2002). Because brand management is critical to the success of both retailers and manufacturers (De Wulf, Odekerken-Schröder, & Goedertier, 2005), creating and maintaining brands is increasingly important in the current highly competitive environment (Seetharaman, Nadzir, & Gunalan, 2001). In this context, the concept of brand equity is a key driver of brand management, from both practitioner and academic viewpoints (Keller & Lehmann, 2006). In general, “brand equity” is defined as the incremental utility or value that a brand name imbues to a product (Farquhar, 1989; Rangaswamy et al., 1993 ; Srivastava and Shocker, 1991). Elements of brand equity positively influence consumers’ perceptions and subsequent brand buying behaviors (Reynolds & Phillips, 2005). With a consumer-based behavioral approach to brand equity, it can be viewed as the differential effect of brand knowledge on consumer response to the marketing of the brand (Keller, 1993). From a managerial point of view, adequately managing brand equity enhances the result and productivity of marketing activities (Keller, 1993 ; Yoo and Donthu, 2001). Therefore, to increase such positive effects and manage brands properly, firms must develop strategies to foster the growth of brand equity (Keller, 2007). In this context, identifying factors that build brand equity represents a central priority for academics and marketing managers (Valette-Florence, Guizani, & Merunka, 2011).

In the domain of private label brands, the phenomenon of their brand equity is only just emerging; research on the topic is scarce. There are few studies focus on comparing manufacturer and private label brand equity (e.g., Ailawadi et al., 2003; De Wulf et al., 2005; Sethuraman and Cole, 1999 ; Suárez et al., 2012) since traditionally, researchers viewed private labels as products with the lowest brand equity in the market (Ailawadi et al., 2003). However, recent studies suggest that private labels are able to enjoy brand equity (Beristain and Zorrilla, 2011; Cuneo et al., 2012 ; De Wulf et al., 2005). Consumer-based private label brand equity research (e.g., Beneke and Zimmerman, 2014; Beristain and Zorrilla, 2011 ; Calvo-Porral et al., 2013) indicates that private label brand equity is a multidimensional construct structured similarly to manufacturer brands but with some particularities. These works show evidence that Aakers (1991) conceptual model can be extended to these particular brands but also highlight the need to further research the topic. Specially, these findings demonstrate that more attention is needed to understand how private label brand equity is created and how it can be managed across the various marketing mix activities that retailers use to support their brands.

Previous research suggests that marketing mix elements are key variables in building brand equity (Yoo, Donthu, & Lee, 2000). In this context, Keller (1993) states that brand equity should be managed over time by fine-tuning the supporting marketing program, because brand equity represents the effect of accumulated marketing investments into the brand (Keller, Heckler, & Houston, 1998). Indeed, a major challenge marketing teams face is deciding on the optimum marketing mix to achieve the greatest impact on the market (Soberman, 2009). Previous studies focus on exploring marketing activities effects on manufacturer brand equity (e.g., Bravo et al., 2007; Buil et al., 2011; Villarejo and Sánchez, 2005 ; Yoo et al., 2000); however, few studies explore which marketing activities contribute most effectively to build private label brand equity.

Although currently, private label brands are considered clear alternatives to manufacturer brands (Kapferer, 2008), we propose that marketing mix efforts might have different effects on private label brand equity. In general, manufacturers rely more on traditional mass media, while retailers engage much more in experience marketing through their stores (De Wulf et al., 2005).

Therefore, to close this research gap, the research goal of this investigation is to measure the effect of some marketing mix elements on the creation of private label brand equity, focusing on in-store specific activities such as in-store communication, in-store promotions and distribution intensity, as well as other marketing mix elements such as advertising, price and monetary promotions.

To analyze the aforementioned relationship, the present research proposes a model that relates marketing mix efforts to the private label brand equity construct. It extends Yoo et al.’s (2000) framework to the domain of private label brands, adding other marketing mix efforts specific to retailers’ marketing strategy. Therefore, the contribution of this paper are twofold: first, to identify the effects of marketing mix efforts on private label brand equity, and second, to add to previous models the in-store specific marketing tools controlled by retailers.

The next section reviews the literature that addresses the effect of marketing mix elements on brand equity. Then, the review narrows to those studies investigating the effect of marketing mix elements on private labels brand equity. The following section discusses these results and introduces additional marketing mix elements, proposes a model and describes the hypotheses derived from it. The subsequent section explains the methodology followed and presents the results obtained. Finally, the article concludes with a discussion of the results and implications of the research, some limitations of the study and suggestions for future lines of research.

Marketing mix efforts and brand equity

In general, brand equity is the utility or value that a brand name gives to a product (Farquhar, 1989). In this study we will consider brand equity from the consumer perspective, therefore, we will build on the literature of Consumer Based Brand Equity (Aaker, 1991; Keller, 1993 ; Yoo et al., 2000). Aaker (1991) considers consumer based brand equity as a set of assets (liabilities) linked to a brands name and symbol that adds to (or subtracts from) the value a product/service provides to customers. This value added can be created through several dimensions: perceived quality, brand loyalty, brand associations, and brand awareness.

Early research has suggested exploring the effect of marketing mix elements on brand equity creation (e.g., Barwise, 1993 ; Shocker et al., 1994). Yoo et al. (2000) empirically investigate whether distribution, price, advertising and store image enhance manufacturer brand equity creation. Subsequent studies identify new effects such as consumers perception of advertising and nonmonetary promotions (Buil et al., 2011).

No early studies address the effect of marketing mix elements on private label brand equity, probably because the first generations of private label brands received no marketing support (Ailawadi & Keller, 2004). Although some retailers exhibited a strategic marketing orientation toward their private labels (Burt, 2000), marketing support of private labels is considered a recent phenomenon.

In the case of private labels, three unique characteristics of private label brands can influence which marketing mix strategies are most effective: First, private label brands are sold exclusively in their retailers; second, private label positioning is influenced by the retailers positioning (Kapferer, 2008), and third, private label brands form a category in consumers’ minds (Nenycz-Thiel and Romaniuk, 2009 ; Nenycz-Thiel et al., 2010), defined by some specific attributes such as perceived value.

The few studies that address marketing mix effects on private label brand equity (Beneke and Zimmerman, 2014; Beristain and Zorrilla, 2011 ; Calvo-Porral and Lévy-Mangín, 2014) focus on store image (considered a marketing tool in this context; e.g., Srivastava & Shocker, 1991) and on the effect of store price image in terms of affordability (Beristain and Zorrilla, 2011 ; Calvo-Porral et al., 2013), both revealing a positive influence on private label brand equity.

Proposed model: justification and hypothesis

As the previous section explains, extensive literature shows that marketing mix efforts have an effect on brand equity creation. Yoo et al.’s (2000) framework indicates the specific marketing mix tools that have proven most relevant in building manufacturers’ brand equity: distribution intensity, advertising, price and store image. However, since private label brands are owned by the distributor and sold exclusively in their stores, other marketing mix elements under the direct control of the retailer, such as in-store promotions and in-store communications are important to consider. Therefore, we extend Yoo et al.’s (2000) model by incorporating these two additional marketing mix initiatives.

In this sense, the current research makes two contributions. First, it represents pioneer research on retailers’ marketing activities for their private label brands, including special activities related to retail environments such as in-store promotions and in-store communication. Second, this work extends the exploration of several selected marketing mix elements on private label brand equity.

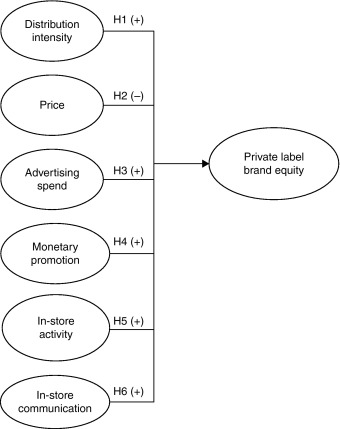

In line with extant literature, the current study hypothesizes directional relationships between marketing efforts and an overall construct of private label brand equity. Fig. 1 summarizes the relational paths among marketing efforts constructs and the private label brand equity construct. The following subsections discuss in depth the hypotheses related to each selected marketing effort.

|

|

|

Fig. 1. Proposed conceptual model. |

In-store promotions

Retailers frequently use point-of-sale promotions to offer “experiences” to consumers (e.g., De Wulf et al., 2005). Because private labels are exclusive and unique of each retailer, they constitute a differentiated ingredient of the point-of-sale experience. Sprott and Shimp (2004) suggest that in-store promotions such as sampling or demonstrations are important tools to increase the perceived quality of private label brands. Since the perceived quality is an important component of the brand equity, we can expect the sampling or demonstrations to have a positive effect on the private labels brand equity. Interestingly, Sprott and Shimp (2004) research shows that the effect of sampling on the perceived quality differs significantly between private labels and manufacturer brands. While sampling activity significantly improves private label perceived quality the same is not true for manufacturers brands.

Moreover, the trial of private labels contributes to decrease the private labels perceived risk that is of critical importance for private labels intention to purchase (Sweeney, Soutar, & Johnson, 1999).

Therefore, we posit that in store promotions are an effective means for enhancing private labels brand equity.

H1.

Private label brand in-store promotions have a positive effect on private label equity.

In-store communication

Following previous arguments, one might expect that retailers use their stores and point of sale to communicate their private label brands. In the context of this investigation it is interesting to highlight that the effects of in store exposure differ between manufacturer brands and private labels (Clement, Aastrup, & Charlotte Forsberg, 2015).

Brown and Lee (1996) suggest that shelf space can be conceived as a way of advertising. Nogales & Suarez, 2005 find that retailers offer more shelf space to their private labels, thus promoting them intensively at the point of sale. One reason for this decision is that increased shelf space enhances consumers’ perception of private label brand quality (Dursun, Kabadayı, Alan, & Sezen, 2011) and the private label brand image (Corstjens & Lal, 2000) thus, increasing private label brand equity. In addition to these arguments, other in-store elements such as posters, banners or features (Gázquez-Abad & Martínez-López, 2016) might help build private label brand awareness and familiarity that, in turn, will increase the overall private label brand equity.

Therefore,

H2.

Private label brand in-store communication has a positive effect on private label brand equity.

Price

Price is a marketing tool used to position and differentiate the product (Yoo et al., 2000). Brand equity literature states that a high price has a positive effect on brand equity (Bravo et al., 2007 ; Yoo et al., 2000) because consumers use price as an extrinsic cue to infer product quality (e.g., Rao & Monroe, 1989). Private label brands are characterized by their perceived value (Kumar & Steenkamp, 2007). Many studies show evidence that the price gap between private label brands and manufacturer brands is a driver of private label brands’ success (e.g., Dhar and Hoch, 1997; Kapferer, 2008 ; Sethuraman, 2003). Thus, consumers expect lower prices for private label brands than for manufacturer brands (Sethuraman, 2000). Indeed, much research has established price as a determinant variable of private label brand success (e.g., Ashley, 1998; Dhar and Hoch, 1997; Raju et al., 1995; Sethuraman and Cole, 1999 ; Sinha and Batra, 1999). In particular, a crucial factor for private label brand success is its positioning in value perception (e.g., Sethuraman, 2000), because an important characteristic consumers associate with private label brands is value (Nenycz-Thiel & Romaniuk, 2012). We therefore posit for private labels a reverse hypothesis about the price effect on brand equity than that of expected for manufacturer brands:

H3.

Private label brand price has a negative effect on private label brand equity.

Monetary promotions

Literature suggests that monetary promotions relate negatively to brand equity (Mela et al., 1998; Valette-Florence et al., 2011 ; Yoo et al., 2000). However, these promotions enlarge the advantageous price gap of private label brand and the attractiveness of purchasing them. Thus, private label brand consumers can consider that they are receiving more value for a lower price due to coupons or price reductions. In this case, monetary promotions would reinforce the private label brands positioning on value. All these arguments lead to the following hypothesis:

H4.

Frequency of private label brand monetary promotions has a positive effect on private label brand equity.

Distribution intensity

Distribution (referred to the availability in number of stores) is a marketing tool aimed to put the product into consumers’ hands in the appropriate place and time (Kreutzer, 1988). Literature evidences that intensive distribution, when products are placed in a large number of stores, is positively related to brand equity (Yoo et al., 2000). In the domain of private label brands, it is intuitively appealing to posit that distribution intensity will also have a positive effect on private labels brand equity. If the private labels are distributed in a large number of retailers’ stores, consumers will have greater exposure to the product, leading to greater brand awareness and satisfaction as consumers save time searching and traveling to stores—in other words, they experience more convenient purchasing. Greater satisfaction will lead to stronger brand loyalty (Yoo et al., 2000), and thus, the effect of distribution intensity on the overall private label brand equity will be positive. Therefore,

H5.

Private label brand distribution intensity has a positive influence on private label brand equity.

Advertising activity

Advertising is one of the most visible marketing tools (Buil et al., 2011 ; De Chernatony, 2010), and it has a positive effect on brand equity (Bravo et al., 2007; Buil et al., 2011; Cobb-Walgren et al., 1995; Simon and Sullivan, 1993; Villarejo and Sánchez, 2005 ; Yoo et al., 2000). By extension, it seems intuitive that in the domain of private label brands, the effect of advertising on private label brand equity will be no different. The following hypothesis synthesizes this argument:

H6.

Private label brand advertising activity has a positive effect on private label brand equity.

Methodology

With the aim of analyzing the proposed model to explore the effect of marketing mix elements on private label brand equity and to empirically test the proposed hypotheses, we conducted a survey in Spain in 2014 using a sample of private label brand consumers. Spain is a relevant country for private labels management since it enjoys the highest the private label share in Europe, 50% (PLMA, 2015).

Data were collected through store-intercept surveys in which consumers responded to a questionnaire consisting of items identified from the literature review. Exploratory factor analysis followed by confirmatory factor analysis using structural modeling (Amos) investigates the relationships between marketing efforts and private label brand equity and examines the hypothesized paths in the proposed model.

Sample selection and data collection

To be eligible for the study, respondents needed to be aware of and familiar with the focal brand on their questionnaire and to have recently bought it. Previous studies on brand equity highlight this filter as necessary in brand equity studies (e.g., Lassar et al., 1995 ; Pappu et al., 2005). In line with previous similar brand equity studies (e.g., Buil et al., 2011; Netemeyer et al., 2004 ; Yoo et al., 2000), two criteria determined the selection of product category and brands: wide availability and consumer familiarity. The product category yogurt fit these criteria well. Three private label brands represented different private label brands from different retailer brand formats.

We selected yogurt, first, because it is a category in a mature market in which private labels are solid accounting for 57.1% of market share in Spain (Alimarket, 2014). Second, this category is large, with numerous brands operating in the Spanish market. Finally, it has been successfully used in previous private label brand research studies (Cuneo et al., 2012).

The yogurt private labels in this study, Hacendado, Carrefour and Milbona, correspond to three different retail brands and formats: Hacendado is the yogurt private label from Mercadona, a lead supermarket; Carrefour is the yogurt private label from Carrefour, a lead hypermarket; and Milbona is the yogurt private label from Lidl, a lead discounter.

These selected private label brands can be classified as third-generation private label brands. We haven’t considered premium private labels since in Spain, similarly to most of the countries in the world, fourth-generation private label brands or premium private label brands account for around 3% of market value (Kantarworld Panel, 2014).

Participants were exposed to one of the three versions of the questionnaire, which were identical except for the private label brand of interest. The data were collected via store-intercept survey using systematic sampling (every three). Field workers collected the data during different times of the day and on different days. The survey yielded a total of 450 complete usable questionnaires. 72.2% of participants were women. Half the respondents were aged between 31 and 50 years. Respondents aged more than 50 years made up 13% and those younger than 30 years accounted for 18.4%. The largest proportion of respondents lived in a family unit of four to five people (38.7%); those living in a household size of two to three people accounted for 37.8%; 15.8% lived in a family unit of more than five people; and 7.8% lived alone.

Survey instrument

A seven-point Likert-type scale measured private label equity, using the anchors “strongly disagree” (1) and “strongly agree”. Likert scales are useful to measure constructs because they can gauge personality, perceptions and attitudes (Bordens and Abbott, 1996 ; Hodge and Gillespie, 2003), and six- to seven-point Likert-type scales have been shown to be optimal (Green & Rao, 1970). A pretest with 20 participants validated the questionnaire. It contained two sections: In Section 1, the 23 items identified from literature review measured marketing mix elements and the construct of the overall private label brand equity. Section 2 included questions on demographics.

Four items from Yoo et al.’s (2000) consumer-based overall brand equity scale measure the incremental value of the focal product due to the brand name. Following Yoo et al. (2000) and Buil et al. (2011), the questionnaire examined perceived rather than actual marketing efforts for two reasons. First, data of actual marketing in the study were not available. Second, perceived marketing efforts play a more direct role in the consumer psychology than actual marketing efforts (Yoo et al., 2000).

Previous research measures private label brand distribution intensity by the number of retail stores where the private label brand is available according to the consumers perception. The questionnaire adapts Yoo et al.’s (2000) three scale items. Private label brand advertising activity was measured as the consumers subjective perception of the intensity of private label advertising activity and the firms investment in it (Buil et al., 2011).

To measure private label brand monetary promotions, the survey asked for the relative perceived frequency of monetary promotions developed on the focal private label brand using Yoo et al. (2000) and Buil et al.’s (2011) three-item scale. To measure in-store promotions, the questionnaire adapts items from Yoo et al. (2000), adding ad hoc items related to private label activities in store, for a total of three items. Finally, in-store communication consists of every visual element consumers can perceive to communicate the focal private brand such as shelf space, posters, banners or leaflets. For this purpose, we developed four ad hoc items based on previous literature (Ailawadi, Beauchamp, Donthu, Gauri, & Shankar, 2009).

Several statistical methods can be used to achieve our results objectives. We chose structural equations modeling methodology since: (i) presence of latent variables (ii) complex relations among the different variables of the model and (iii) the need to test the theory of the model (Bielby and Hauser, 1977 ; Kline, 2015). Therefore, the confirmatory factor analysis using structural equations modeling tested the unidimensionality of the marketing mix elements. The 23 items obtained from the exploratory factor analysis served as indicator variables in the confirmatory factor analysis.

Results

Measurement model

Cronbachs reliability, exploratory factor analysis and confirmatory analysis were used to select and assess the final items used for hypothesis tests. Cronbachs measure reliability coefficient was first calculated for the items in each marketing effort construct and for the overall private label construct. Cronbachs alpha for all the constructs were above 0.70, the cutoff level of reliability recommended (Nunnally & Bernstein, 1994). Exploratory factor analysis then examined whether the items produce the proposed factors and whether the individual items are loaded on their appropriate factors. Factor analysis using principal component analysis and Varimax method suggested seven factors. All the indicators were significant, with factor loading higher than 0.7 and no cross loading. The explained variance exceeded 60% in each case. A Bartlett test and Kaiser–Meyer–Olkin (KMO) index were satisfactory (significant and above 0.7, respectively).

Following Anderson and Gerbing (1988), a two-step approach for structural equation modeling was executed. First, a confirmatory analysis detected the unidimensionality of each construct, and then a structural model tested the proposed hypotheses. The analysis uses Amos 21 maximum-likelihood estimation method. However, it is important to highlight that this method requires multivariable normality in every observed variable. The result of multivariate kurtosis coefficient was 47,783, indicating that sample did not presented a normal distribution (Mardia, 1974). An approach to manage the presence of nonnormal multivariable data is to use the bootstrap procedure (West et al., 1995; Yung and Bentler, 1996 ; Zhu, 1997), as suggested by Bollen and Stine (1993). We ran a resampling of 1000 bootstraps, in accordance with our sample size Nevitt and Hancock (2001). The confidence intervals of regression coefficients and standardized regression coefficients revealed that estimated values were significantly different from zero, suggesting that the model was acceptable. Confirmatory factor analysis (CFA) confirmed the adequacy of all the proposed items to measure the constructs. Furthermore, CFA of the multi-item scale produced an acceptable fit for the data accordingly to Hu & Bentler, 1999Hu and Bentlers (1999) goodness-of-fit criteria (see Table 1). Composite reliability (CR) values are greater than 0.6 (Bagozzi & Yi, 1988) and Cronbach value is superior than 0.7 (Nunnally & Bernstein, 1994) which guarantee the good internal validity of the measurement model. In addition, average variance extracted (AVE) is above 0.5 that indicates the percentage of variance explained by the items (Fornell & Larcker, 1981) and confirms the convergent validity of the model. In addition, all factor loadings are above 0.5 and the t-values associated to them are statistically significant (at 0.05 significance level), suggesting a considerable convergent validity (see Table 2).

| Constructs, items and measurement | Standardized loadings | t value | |

|---|---|---|---|

| Distribution intensity (CR = 0.72; AVE = 0.71; Cronbachs alpha = 0.95) | |||

| DIS1 | More retailers sell yogurt X, as compared to other competing yogurts brands | 0.92 | * |

| DIS2 | The number of retailers that deal with yogurt X is more than that of its competing brands | 0.96 | 40.292 |

| DIS3 | Yogurt X is distributed through as many retailers as possible | 0.93 | 33.949 |

| Price (CR = 0.72; AVE = 0.75; Cronbach = 0.94) | |||

| PRI1 | The price of yogurt X is high | 0.97 | * |

| PRI2 | The price of yogurt X is low (r) | 0.85 | 31.235 |

| PRI3 | Yogurt X is expensive | 0.95 | 46.165 |

| Advertising activity (CR = 0.80; AVE = 0.69; Cronbachs alpha = 0.95) | |||

| ADS1 | Yogurt X is intensively advertised | 0.92 | * |

| ADS2 | Yogurt X spends a lot in advertising compared to other competing yogurt brands | 0.95 | 40.307 |

| ADS3 | The advertisements for yogurt X are frequently shown | 0.93 | 36.682 |

| Monetary promotion (CR = 0.71; AVE = 0.68; Cronbachs alpha = 0.94) | |||

| PROM1 | Price deals for yogurt X are frequently offered | 0.95 | * |

| PROM2 | Too many times prices deals for yogurt X are presented | 0.91 | 34.934 |

| PROM3 | Price deals for yogurt X are more frequent than competing brands of yogurt | 0.91 | 34.882 |

| In-store promotions (CR = 0.71 AVE = 0.78; Cronbachs alpha = 0.93) | |||

| ACT1 | Yogurt X frequently offers tasting in store | 0.81 | * |

| ACT2 | Store employees frequently recommend yogurt X | 0.96 | 26.890 |

| ACT3 | Store employees often inform me about yogurt X | 0.96 | 27.104 |

| In-store communication (CR = 0.48; AVE = 0.82; Cronbachs alpha = 0.90) | |||

| INSTO1 | Yogurt X has more space on retailer shelves, as compared to other competing yogurt brands | 0.75 | * |

| INSTO2 | Yogurt X has more visual elements (posters), as compared to other competing yogurt brands | 0.89 | 17.512 |

| INSTO3 | There are many more retail activities in yogurt X, as compared to other competing retailers | 0.86 | 18.325 |

| INSTO4 | Yogurt X appears more advertised in retailer leaflets, as compared to other competing yogurt brands | 0.82 | 20.102 |

| Overall Private Label Equity (CR = 0.67; AVE = 0.66 Cronbachs alpha = 0.96) | |||

| OB1 | It makes sense to buy yogurt X instead of any other brand, even if they are the same | 0.87 | * |

| OB2 | Even if another yogurt brand has same features as X, I would prefer to buy X | 0.94 | 31.400 |

| OB3 | If there is another brand of yogurt as good as yogurt brand X, I prefer to buy yoghurt | 0.93 | 30.660 |

| OB4 | If another yogurt brand is not different from yogurt brand X, it seems smarter to purchase X | 0.88 | 27.199 |

Notes: X focal private label. (r) = reverse code. One factor loading parameter in each set of loadings that measure the same factor is constrained to 1. The goodness-of-fit statistics of the measurement model of 23 indicators for 7 constructs are as follows: ; goodness of fit index = 0.92; adjusted goodness-of-fit index = 0.89; incremental fit index = 0.98; normed fit index = 0.96; Tucker–Lewis index = 0.97; comparative fit index = 0.98; root mean square error of approximation = 0.05; standardized root mean residual = 0.04.

- . Significant at p < 0.05.

| Construct | Correlation | ||||||

|---|---|---|---|---|---|---|---|

| F1 | F2 | F3 | F4 | F5 | F6 | F7 | |

| F1. Distribution intensity | 0.843 | ||||||

| F2. Perceived price | 0.319 | 0.866 | |||||

| F3. Advertising activity | 0.559 | 0.264 | 0.831 | ||||

| F4. Monetary promotion | 0.455 | 0.294 | 0.599 | 0.825 | |||

| F5. In-store promotion | 0.533 | 0.400 | 0.547 | 0.583 | 0.883 | ||

| F6. In-store communication | 0.474 | 0.181 | 0.431 | 0.374 | 0.454 | 0.907 | |

| F7. Overall private label brand equity | 0.298 | -0.039 | 0.132 | 0.124 | 0.146 | 0.285 | 0.806 |

To test discriminant validity we used Fornell and Larcker (1981) criteria. According to it, the extracted variance (VE) for any two constructs should be always greater that the squared correlation estimate. Results confirm the discriminant validity of the model (see Table 3).

| Hypothesized relationship | Standarised loading | t value | Hypothesis | Conclusion |

|---|---|---|---|---|

| In-store promotions → PL brand equity | −0.140 | −0.204 | H1 | Not supported |

| In-store communications → PL brand equity | 0.210 | 3.591 | H2 | Supported |

| Perceived price → PL brand equity | −0.146 | −2.860 | H3 | Supported |

| Monetary promotion → PL brand equity | 0.070 | 0.119 | H4 | Not supported |

| Distribution intensity → PL brand equity | 0.295 | 4.691 | H5 | Supported |

| Advertising intensity → PL brand equity | −0.810 | −1.255 | H6 | Not supported |

Note: Significant, p < 0.05.

PL: private label.

Structural equations modeling

Once reliability, dimensionality and validity of the multi-item scales were assessed, the parameters of the structural model were estimated. Goodness-of-fit (GFI) statistics indicating the overall acceptability of the structural model analyzed (see Table 2) were acceptable: GFI: 0.92; adjusted goodness-of-fit index (AGFI) = 0.89; normed fit index (NFI) = 0.96; incremental fit index (IFI) = 0.98; Tucker–Lewis index (TLI): 0.98; confirmatory fit index (CFI) = 0.98; root means square approximation (RMSA) = 0.05; standardized root mean square residual (SRMR) = 0.04. Although the chi-square is not significant (; p = 0.000), it cannot be considered a reliable indicator of GFI because the samples exceeded 200 cases (Bollen, 1989). In most cases, path coefficients were significant (p < 0.05), and evidence supports several of our hypotheses. The following subsections discuss these results, and Table 3 summarizes them.

Relationships of selected marketing mix elements with private label equity

In-store communication of private label brands has a positive influence on private label brand equity, in support of H1. However, the data do not confirm the effects of other marketing elements such as: advertising activity, monetary promotions and in-store promotion (H6, H4 and H1). As hypothesized, the positive effect of distribution intensity on private label brand equity was supported (H5). Findings also reveal that private label brand price has a negative influence on private label brand equity creation and maintenance, in support of H3. This result contradicts previous knowledge about the positive effects of high price on brand equity of manufacturer brands. In the particular case of private label brand, the direction of this effect on brand equity is opposite. In summary, the results suggest that the marketing mix elements that show the greatest effects on private label brand equity are private label brand distribution intensity (0.294), private label brand in-store communication (0.210) and private label brand price (−0.146) (see Table 3).

Discussion and conclusions

The current study explores the relationships between private label brand equity and several marketing mix elements that retailers use to support their private labels: in-store promotion, in-store communication, distribution intensity, price, advertising activity and monetary promotions.

Our research reveals important academic and managerial implications. For the retailers the current research shows effective means to build the brand equity of their private labels. For academics our research contributes to the scarce brand equity literature on private labels suggesting new elements and factors to consider.

Our results show that private labels in-store communication, its distribution (availability in number of stores) and the perceived price play an important role in building private label brand equity. This research underlines the importance of in-store communication as opposed to advertising that in the context of our research shows no effect on private labels brand equity.

These results can be explained from different perspectives. In the first place, retailers invest less in advertising than lead manufacturer brands do since retailers tend to leverage the advertising of manufacturer brands to grow their private labels (Soberman & Parker, 2006). On the other hand, when retailers enhance private labels exposure in the store, which they control, it is possible that the effect of this exposure in consumers is stronger than the exposure of a mere advertising commercial.

Previous research shows that the effect of some in store communication activities differ between manufacturer brands and private labels (Clement et al., 2015). Therefore, our results underscore important implications for the brand management of private labels since they suggest in store marketing as a possible source of competitive advantage for private labels versus manufacturer brands. Given that consumers make a majority of decisions in the store and they are affected by the stimuli they find there our results are even more significant.

These results along with the positive effect of distribution intensity on the private label brand equity highlight the importance of the store as primary source of private labels brand equity. Distribution intensity, i.e., the level of availability of the private label brand, is an important driver of the private label brand equity. Although private label brands are unique, exclusive for every retailer, consumers’ perception of private labels distribution positively affects brand equity. Given that retailers’ strategy regarding the number of outlets seems difficult to change, this result suggests the importance of seeking alternatives when physical distribution will not be possible. For example, availability in online channels might compensate the limited number of stores where the retailer operates, even slightly increasing their share (Dawes & Nenycz-Thiel, 2014). In addition, some cobranding or cross-service strategy, such as retailers’ agreement with some petrol stations, might also contribute to increase the availability perception.

Concerning price, the private label brand perceived price is a key factor for its success, in that private label consumers expect advantageous prices. In this context, price is an important tool to offer a value proposal to the market and an alternative to manufacturer brand positioning. In general, price is considered an external cue of perceived quality. Indeed, previous research on manufacturer brand equity suggests that a high price has a positive effect on brand equity because consumers relate price to product quality. Interestingly enough, however, our results reveal that a higher price perception of private labels negatively affects their brand equity. This counterintuitive result can be explained, as we hypothesized, since private label brand price is not an indicator of the brand quality but rather a reflection of the retailer price positioning (González-Benito & Martos-Partal, 2014). Some anecdotal evidence illustrates this result: Retailers’ aggressive positioning in price does not mean that their private label brands’ price advantage, which can be as large as 30% over manufacturer brands, reflects a comparable difference in quality (Rubio et al., 2014 ; Apelbaum et al., 2003). Similarly, consumers will not infer significantly improved quality with an increase in price in a private label, because their categorization of these brands would lead them to expect value as an intrinsic characteristic. Model-free evidence in brands with high perceived value positioning such as Zara or H&M sheds light on this result: Higher prices for these two brands does not necessarily positively contribute to an increase in their brand equity.

Limitations and further research

As with all empirical studies, the current research has several limitations, and overcoming them can be a guide for future research. First, the data are based on consumer surveys; therefore, the research is not exempt from individual subjectivity. Future research could combine actual measures of marketing activities with perceptual measures. Second, the current research explores the effect of some marketing mix elements on overall private label brand equity. Future research could extend the model to include additional dimensions of the consumer-based brand equity construct in order to better understand the brand equity creation process. Third, the current study does not include all possible marketing activities retailers use to support their private label brands. Future research might include other marketing tools such as the use of slogans (Aaker, 1991), company image (Keller, 1993) or brand-naming strategy (Keller et al., 1998) to improve the knowledge of private label brand equity creation. Finally, this research is limited to Spain and to one product category. Future research should consider different countries and market differences in product categories and private label strategy.

References

- Aaker, 1991 D.A. Aaker; Managing brand equity: Capitalising on the value of a brand name; The Free Press, New York (1991)

- Ailawadi et al., 2009 K.L. Ailawadi, J.P. Beauchamp, N. Donthu, D.K. Gauri, V. Shankar; Communication and promotion decisions in retailing: A review and directions for future research; Journal of Retailing, 85 (1) (2009), pp. 42–55

- Ailawadi and Keller, 2004 K.L. Ailawadi, K.L. Keller; Understanding retail branding: Conceptual insights and research priorities; Journal of Retailing, 80 (4) (2004), pp. 331–342

- Ailawadi et al., 2003 K.L. Ailawadi, D.R. Lehmann, S.A. Neslin; Revenue premium as an outcome measure of brand equity; Journal of Marketing, 67 (4) (2003), pp. 1–17

- Alimarket, 2014 Alimarket (2014). Retrieved www.alimarket.es.

- Anderson and Gerbing, 1988 J.C. Anderson, D. Gerbing; Structural modeling in practice: A review and recommended two-step approach; Psychological Bulletin, 103 (3) (1988), pp. 411–423

- Apelbaum et al., 2003 E. Apelbaum, E. Gerstner, P.A. Naik; The effects of expert quality evaluations versus brand name on price premiums; Journal of Product & Brand Management, 12 (3) (2003), pp. 154–165

- Ashley, 1998 R. Ashley; How to effectively compete against private-label brands; Journal of Advertising Research, 38 (1) (1998), pp. 75–82

- Bagozzi and Yi, 1988 R.P. Bagozzi, Y. Yi; On the evaluation of structural equation models; Journal of the Academy of Marketing Science, 16 (1) (1988), pp. 74–94

- Barwise, 1993 P. Barwise; Brand equity: Snark or boojum?; International Journal of Research in Marketing, 10 (1) (1993), pp. 93–104

- Beneke and Zimmerman, 2014 J. Beneke, N. Zimmerman; Beyond private label panache: The effect of store image and perceived price on brand prestige; Journal of Consumer Marketing, 31 (4) (2014), pp. 301–311

- Beristain and Zorrilla, 2011 J. Beristain, P. Zorrilla; The relationship between store image and store brand equity: A conceptual framework and evidence from hypermarkets; Journal of Retailing and Consumer Services, 18 (6) (2011), pp. 562–574

- Bielby and Hauser, 1977 W.T. Bielby, R.M. Hauser; Structural equation models; Annual Review of Sociology (1977), pp. 137–161

- Bigné et al., 2013 E. Bigné, A. Borredá, M.J. Miquel; El valor del establecimiento y su relación con la imagen de marca privada: efecto moderador del conocimiento de la marca privada como oferta propia del establecimiento; Revista Europea de Dirección y Economía de la Empresa, 22 (1) (2013), pp. 1–10

- Bollen, 1989 K.A. Bollen; Structural equations with latent variables; John Wiley and Sons, New York, NY (1989)

- Bollen and Stine, 1993 K.A. Bollen, R.A. Stine; Bootstrapping goodness-of-fit measures in structural equation modelling; K.A. Bollen, J.S. Long (Eds.), Testing structural equation models, Sage Publications, Newbury Park, CA (1993), pp. 111–135

- Bonfrer and Chintagunta, 2004 A. Bonfrer, P.K. Chintagunta; Store brands: Who buys them and what happens to retail prices when they are introduced?; Review of Industrial Organization, 24 (2) (2004), pp. 195–218

- Bordens and Abbott, 1996 K.S. Bordens, B.B. Abbott; Research design and methods: A process approach; (3rd ed.)Mayfield Publishing Company, Mountain View, CA (1996)

- Bravo et al., 2007 R. Bravo, E. Fraj, E. Martinez; Family as a source of consumer-based brand equity; Journal of Product & Brand Management, 16 (3) (2007), pp. 188–199

- Brown and Lee, 1996 M.G. Brown, J.Y. Lee; Allocation of shelf space: A case study of refrigerated juice products in grocery stores; Agribusiness, 12 (2) (1996), pp. 113–121

- Buil et al., 2011 I. Buil, L. de Chernatony, E. Martínez; Examining the role of advertising and sales promotions in brand equity creation; Journal of Business Research, 66 (1) (2011), pp. 115–122

- Burt, 2000 S. Burt; The strategic role of retail brands in British grocery retailing; European Journal of Marketing, 38 (8) (2000), pp. 875–886

- Calvo-Porral and Lévy-Mangín, 2014 C. Calvo-Porral, J.P. Lévy-Mangín; Private label brands: Major perspective of two customer-based brand equity models; International Review of Retail, Distribution and Consumer Research, 24 (2) (2014), pp. 1–22

- Calvo-Porral et al., 2013 C. Calvo-Porral, V. Martinez Fernandez, O. Juanatey Boga, J.P. Levy-Mangin; What matters to store brand equity? An approach to Spanish large retailing in a downturn context; Investigaciones Europeas de Dirección y Economía de la Empresa, 20 (2) (2013), pp. 1–11

- Clement et al., 2015 J. Clement, J. Aastrup, S. Charlotte Forsberg; Decisive visual saliency and consumers’ in-store decisions; Journal of Retailing & Consumer Services, 22 (2015), pp. 187–194

- Cobb-Walgren et al., 1995 C. Cobb-Walgren, C.A. Ruble, N. Donthu; Brand equity, brand preference and purchase intent; Journal of Advertising, 24 (3) (1995), pp. 25–40

- Collins-Dodd and Lindley, 2003 C. Collins-Dodd, T. Lindley; Store brands and retail differentiation: The influence of store image and store brand attitude on store own brand perceptions; Journal of Retailing and Consumer Services, 10 (6) (2003), pp. 345–352

- Corstjens and Lal, 2000 M. Corstjens, R. Lal; Building store loyalty through store brands; Journal of Marketing Research, 37 (3) (2000), pp. 281–291

- Cuneo et al., 2012 A. Cuneo, P. Lopez, M.J. Yague; Measuring private labels brand equity: A consumer perspective; European Journal of Marketing, 46 (7/8) (2012), pp. 952–964

- Dawes and Nenycz-Thiel, 2014 J. Dawes, M. Nenycz-Thiel; Comparing retailer purchase patterns and brand metrics for in-store and online grocery purchasing; Journal of Marketing Management, 30 (3–4) (2014), pp. 364–382

- De Chernatony, 2010 L. De Chernatony; From brand vision to brand evaluation: The strategic process of growing and strengthening brands; Routledge (2010)

- Dekimpe and Steenkamp, 2002 M. Dekimpe, J. Steenkamp; Lessons to be learnt from the Dutch private-label scene; European Retail Digest, 34 (2002), pp. 33–35

- De Wulf et al., 2005 K. De Wulf, G. Odekerken-Schröder, F. Goedertier; Consumer perceptions of store brands versus national brands; Journal of Consumer Marketing, 22 (4) (2005), pp. 223–232

- Dhar and Hoch, 1997 S.K. Dhar, S.J. Hoch; Why store brand penetration varies by retailer; Marketing Science, 16 (3) (1997), pp. 208–227

- Dursun et al., 2011 İ. Dursun, E.T. Kabadayı, A.K. Alan, B. Sezen; Store brand purchase intention: Effects of risk, quality, familiarity and store brand shelf space; Procedia-Social and Behavioral Sciences, 24 (2011), pp. 1190–1200

- Farquhar, 1989 P.H. Farquhar; Managing brand equity; Marketing Research, 1 (3) (1989), pp. 24–33

- Fornell and Larcker, 1981 C. Fornell, D.F. Larcker; Evaluating structural equation models with unobservable variables and measurement error; Journal of Marketing Research, 18 (1) (1981), pp. 39–50

- Gázquez-Abad and Martínez-López, 2016 J.C. Gázquez-Abad, F.J. Martínez-López; Understanding the impact of store flyers on purchase behaviour: An empirical analysis in the context of Spanish households; Journal of Retailing and Consumer Services, 28 (2016), pp. 263–273

- González-Benito and Martos-Partal, 2014 Ó. González-Benito, M. Martos-Partal; Price sensitivity versus perceived quality: Moderating effects of retailer positioning on private label consumption; Journal of Business Economics and Management, 15 (5) (2014), pp. 935–950

- Green and Rao, 1970 P.E. Green, V.R. Rao; Rating scales and information recovery: How many scales and response categories to use?; Journal of Marketing, 34 (3) (1970), pp. 33–39

- Grewal et al., 1998 D. Grewal, R. Krishnan, J. Baker, N. Borin; The effect of store name, brand name and price discounts on consumers’ evaluations and purchase intentions; Journal of Retailing, 74 (3) (1998), pp. 331–352

- Hoch and Banerji, 1993 S.J. Hoch, S. Banerji; When do private labels succeed?; Sloan Management Review, 34 (4) (1993), pp. 57–67

- Hodge and Gillespie, 2003 D.R. Hodge, D. Gillespie; Phrase completions: An alternative to Likert scales; Social Work Research, 27 (2003), pp. 45–55

- Hu and Bentler, 1999 L.-T. Hu, P. Bentler; Cutoff criteria for fit indexes in covariance structure analysis: Conventional criteria versus new alternatives; Structural Equation Modeling, 6 (1999), pp. 1–55

- Kantarworld Panel, 2014 Kantarworld Panel (2014). Retrieved from www.kantarworldpanel.es.

- Kapferer, 2008 J.N. Kapferer; The new strategic brand management: Creating and sustaining brand equity long term; Kogan Page, London (2008)

- Keller, 2007 E. Keller; Unleashing the power of word of mouth: Creating brand advocacy to drive growth; Journal of Advertising Research, 47 (4) (2007), pp. 448–452

- Keller, 1993 K.L. Keller; Conceptualizing, measuring, and managing customer-based brand equity; Journal of Marketing, 57 (1) (1993), pp. 1–22

- Keller et al., 1998 K.L. Keller, S.E. Heckler, M.J. Houston; The effects of brand name suggestiveness on advertising recall; Journal of Marketing, 62 (1) (1998), pp. 48–57

- Keller and Lehmann, 2006 K.L. Keller, D.R. Lehmann; Brands and branding: Research findings and future priorities; Marketing Science, 25 (6) (2006), pp. 740–759

- Kline, 2015 R.B. Kline; Principles and practice of structural equation modeling; Guilford publications (2015)

- Kreutzer, 1988 R.T. Kreutzer; Marketing-mix standardisation: An integrated approach in global marketing; European Journal of Marketing, 22 (10) (1988), pp. 19–30

- Kumar and Steenkamp, 2007 N. Kumar, J.-B.E. Steenkamp; Private label strategy; Harvard Business School Press, Boston, MA (2007)

- Lassar et al., 1995 W. Lassar, B. Mittal, A. Sharma; Measuring customer-based brand equity; Journal of Consumer Marketing, 12 (4) (1995), pp. 11–19

- Mardia, 1974 K.V. Mardia; Applications of some measures of multivariate skewness and kurtosis in testing normality and robustness studies; Sankhya, B36 (1974), pp. 115–128

- Mela et al., 1998 C.F. Mela, K. Jedidi, D. Bowman; The long-term impact of promotions on consumer stockpiling behaviour; Journal of Marketing Research, 35 (2) (1998), pp. 250–262

- Miquel-Romero et al., 2014 M.J. Miquel-Romero, E.M. Caplliure-Giner, C. Adame-Sánchez; Relationship marketing management: Its importance in private label extension; Journal of Business Research, 67 (5) (2014), pp. 667–672

- Nenycz-Thiel and Romaniuk, 2009 M. Nenycz-Thiel, J. Romaniuk; Perceptual categorization of private labels and national brands; Journal of Product & Brand Management, 18 (4) (2009), pp. 251–261

- Nenycz-Thiel and Romaniuk, 2012 M. Nenycz-Thiel, J. Romaniuk; Value-for-money perceptions of supermarket and private labels; Australasian Marketing Journal, 20 (2) (2012), pp. 171–177

- Nenycz-Thiel et al., 2010 M. Nenycz-Thiel, B. Sharp, J. Dawes, J. Romaniuk; Competition for memory retrieval between private label and national brands; Journal of Business Research, 63 (11) (2010), pp. 1142–1147

- Netemeyer et al., 2004 R.G. Netemeyer, B. Krishnan, C. Pullig, G. Wang, M. Yagci, D. Dean, et al.; Developing and validating measures of facets of customer-based brand equity; Journal of Business Research, 57 (2) (2004), pp. 209–224

- Nevitt and Hancock, 2001 J. Nevitt, G.R. Hancock; Performance of bootstrapping approaches to model test statistics and parameter standard error estimation in structural equation modelling; Structural Equation Modeling: A Multidisciplinary Journal, 8 (2001), pp. 353–377

- Nogales and Suarez, 2005 A.F. Nogales, M.G. Suarez; Shelf space management of private labels: A case study in Spanish retailing; Journal of Retailing and Consumer Services, 12 (3) (2005), pp. 205–216

- Nunnally and Bernstein, 1994 J.C. Nunnally, I.H. Bernstein; Psychometric theory; (3rd ed.)McGraw-Hill, New York, NY (1994)

- Pappu et al., 2005 R. Pappu, P.G. Quester, R.W. Cooksey; Consumer-based brand equity: Improving the measurement – Empirical evidence; Journal of Product & Brand Management, 14 (3) (2005), pp. 143–154

- PLMA, 2015 PLMA (2015). Retrieved from http://www.plmainternational.com.

- Raju et al., 1995 J. Raju, R. Sethuraman, S. Dhar; The introduction and performance of store brands; Management Science, 41 (6) (1995), pp. 957–978

- Rangaswamy et al., 1993 A. Rangaswamy, R.R. Burke, T.A. Oliva; Brand equity and the extendibility of brand names; International Journal of Research in Marketing, 10 (1) (1993), pp. 61–75

- Rao and Monroe, 1989 A.R. Rao, K.B. Monroe; The effect of price, brand name, and store name on buyers’ perceptions of product quality: An integrative review; Journal of Marketing Research, 26 (3) (1989), pp. 351–357

- Reynolds and Phillips, 2005 T.J. Reynolds, C.B. Phillips; In search of true brand equity metrics: All market share ain’t created equal; Journal of Advertising Research, 45 (2) (2005), pp. 71–86

- Richardson et al., 1996 P.S. Richardson, A.K. Jain, A. Dick; Household store brand proneness: A framework; Journal of Retailing, 72 (2) (1996), pp. 159–185

- Rubio et al., 2014 N. Rubio, J. Oubiña, N. Villaseñor; Brand awareness – Brand quality inference and consumers risk perception in store brands of food products; Food Quality and Preference, 32 (2014), pp. 289–298

- Seetharaman et al., 2001 A. Seetharaman, Z.A.B.M. Nadzir, S. Gunalan; A conceptual study on brand valuation; Journal of Product & Brand Management, 10 (4) (2001), pp. 243–256

- Semeijn et al., 2004 J. Semeijn, A.C.R. Van Riel, B.A. Amborsini; Consumers’ evaluations of store brands: Effect of store image and product attributes; Journal of Retailing and Consumer Services, 11 (2004), pp. 247–258

- Sethuraman, 2000 R. Sethuraman; What makes consumers pay more for national brands than for private labels: Image or quality?; Marketing Science Institute Paper Series, 00-110 (2000)

- Sethuraman, 2003 R. Sethuraman; Measuring national brands’ equity over store brands and exploring its antecedents; Review of Marketing Science, 1 (1) (2003)

- Sethuraman and Cole, 1999 R. Sethuraman, C. Cole; Factors influencing the price premiums that consumers pay for national brands over store brands; Journal of Product & Brand Management, 8 (4) (1999), pp. 340–351

- Shocker et al., 1994 A.D. Shocker, R.K. Srivastava, R.W. Reukert; Challenges and opportunities facing brand management: An introduction to the special issue; Journal of Marketing Research, 31 (1994), pp. 149–158

- Simon and Sullivan, 1993 C.J. Simon, M.W. Sullivan; The measurement and determinants of brand equity: A financial approach; Marketing Science, 12 (1) (1993), pp. 28–52

- Sinha and Batra, 1999 I. Sinha, R. Batra; The effect of consumer price consciousness on private label purchase; International Journal of Research in Marketing, 16 (1999), pp. 237–251

- Soberman, 2009 D.A. Soberman; Marketing agencies, media experts and sales agents: Helping competitive firms improve the effectiveness of marketing; International Journal of Research in Marketing, 26 (2009), pp. 21–33

- Soberman and Parker, 2006 D.A. Soberman, P.M. Parker; The economics of quality-equivalent store brands; International Journal of Research In Marketing, 23 (2) (2006), pp. 125–139

- Sprott and Shimp, 2004 D.E. Sprott, T.A. Shimp; Using product sampling to augment the perceived quality of store brands; Journal of Retailing, 80 (4) (2004), pp. 305–315

- Srivastava and Shocker, 1991 K. Srivastava, A.D. Shocker; Brand equity: A perspective on its meaning and measurement; Marketing Science Institute, Cambridge, MA (1991)

- Sweeney et al., 1999 J.C. Sweeney, G.N. Soutar, L.W. Johnson; The role of perceived risk in the quality-value relationship: A study in a retail environment; Journal of Retailing, 75 (1) (1999), pp. 77–105

- Suárez et al., 2012 M.G. Suárez, A.F. Nogales, C.A. Barrie; Aspectos diferentes en la medición de capital de marca de distribuidor: un modelo agregado; Revista europea de dirección y economía de la empresa, 21 (1) (2012), pp. 97–111

- Sudhir and Talukdar, 2004 K. Sudhir, D. Talukdar; Does store brand patronage improve store patronage?; Review of Industrial Organization, 24 (2) (2004), pp. 143–160

- Valette-Florence et al., 2011 P. Valette-Florence, H. Guizani, D. Merunka; The impact of brand personality and sales promotions on brand equity; Journal of Business Research, 64 (2011), pp. 24–28

- Villarejo and Sánchez, 2005 A.F. Villarejo, M.J. Sánchez; The impact of marketing communication and price promotion on brand equity; Journal of Brand Management, 12 (6) (2005), pp. 431–445

- West et al., 1995 S.G. West, J.F. Finch, P.J. Curran; Structural equation models with non-normal variables: Problems and remedies; R.H. Hoyle (Ed.), Structural equation modeling: Concepts, issues and applications, Sage Publications, Thousand Oaks, CA (1995)

- Wu et al., 2011 P. Wu, G.Y.Y. Yeh, C.R. Hsiao; The effect of store image and service quality on brand image and purchase intention for private label brands; Australasian Marketing Journal, 19 (1) (2011), pp. 30–39

- Yoo and Donthu, 2001 B. Yoo, N. Donthu; Developing and validating a multidimensional consumer-based brand equity scale; Journal of Business Research, 52 (1) (2001), pp. 1–14

- Yoo et al., 2000 B. Yoo, N. Donthu, S. Lee; An examination of selected marketing mix elements and brand equity; Academy of Marketing Science Journal, 28 (2) (2000), pp. 195–211

- Yung and Bentler, 1996 Y.F. Yung, P.M. Bentler; Bootstrapping techniques in analysis of mean and covariance structures; G.A. Marcoulides, R.E. Schumacker (Eds.), Advanced structural equation modeling. Issues and techniques, Lawrence Erlbaum, Mahwah, NJ (1996), pp. 125–157

- Zhu, 1997 W. Zhu; Making bootstrap statistical inferences: A tutorial; Research Quarterly for Exercise and Sport, 68 (1) (1997), pp. 44–55

Document information

Published on 12/06/17

Submitted on 12/06/17

Licence: Other

Share this document

Keywords

claim authorship

Are you one of the authors of this document?