Abstract

To achieve the goals of national sustainable development, the peaking control of CO2 emissions is pivotal, as well as other pollutants. In this paper, we build a Chinese inter-regional CGE model and simulate 13 policies and their combinations. By analyzing the energy consumptions, coal consumptions, relating emissions and their impacts on GDP, we found that with the structure adjustment policy, the proportion of coal in primary fossil fuels in 2030 will decrease from 53% to 48% and CO2 emissions will decrease by 11.3%–22.8% compared to the baseline scenario. With the energy intensity reduction policy, CO2 emissions will decrease by 33.3% in 2030 and 47.8% in 2050 than baseline scenario. Other pollutants will also be controlled as synergetic effects. In this study we also find that although the earlier the peaking time the better for emission amounts control, the economic costs can not be ignored. The GDP will decrease by 2.96%–8.23% under different scenarios. Therefore, integrated policy solutions are needed for realizing the peaks package and more targeted measures are required to achieve the peaks of other pollutants earlier.

Keywords

CO2 emission peak ; PM2.5 ; Policy scenario ; Economic impacts ; Synergetic effects

1. Introduction

Chinas recent economic development has been profound; however, soaring energy consumption and increased CO2 emissions have inevitably become a result of this growth. For several years, Chinas CO2 emissions have been the largest in the world. A far cry from sustainability, the traditional pathways to high-speed industrialization and urbanization resulted in elevated levels of pollutants, low energy efficiency and significant impacts to Chinas natural resources and environment. From a long-term view, both international pressures and domestic demands require China to seek energy saving methods and low carbon development. In that realm, China has developed a framework of sustainable strategies and laws, along with plans targeting energy conservation and structure adjustment.

If China can lower its carbon footprint, it would not only be an indication of Chinas international climate commitment, but also it would represent an important global demonstration, especially for other developing countries. In some sense, the emission peaking time and establishing the emissions peak levels reflect a countrys development mode and the process of improving environmental quality. The research and estimation of Chinas emission peak levels are vital to deciding the sustainable path of economic growth and environmental improvement (SDSSGCAS, 2014 ). In this study, we utilize different scenarios to simulate and analyze CO2 emission peaks and emission reduction methods.

Through the simulation and analysis, we hope to shed light on Chinas policy choices for emission reduction and the synergetic effects on other challenges. By conducting this quantitative study, we try to answer these questions: What is the time range of Chinas emission peaks? What are the costs and benefits of the emission reduction measures? What are the candidate policy combinations? What are the emission trends of energy intensive sectors?

2. Method and scenarios

We implemented a multi-regional general equilibrium model based on a 58 sectors IO, which is drawn from the 42-sectors 2007 Chinese National IO Tables (NBSC, 2009 ) by decomposing 4 energy production related sectors. The redepartmentation of IO is shown in Table 1 .

| Original sector | Decomposed sector |

|---|---|

| Mining and washing of coal | Mining and washing of coal |

| Coal | |

| Cleaned coal | |

| Other cleaned coal | |

| Petroleum and natural gas extraction | Petroleum and natural gas extraction |

| Crude oil | |

| Natural gas | |

| Petroleum processing, coking, and nuclear fuel processing | Petroleum processing, coking, and nuclear fuel processing |

| Gasoline | |

| Kerosene | |

| Diesel oil | |

| Fuel pil | |

| Liquefied petroleum gas | |

| Other petroleum products | |

| Coke | |

| Coke oven gas | |

| Other coking products | |

| Electricity and heat production and supply | Electricity and heat production and supply |

| Heat | |

| Electricity |

Note: The decomposed sector with the same name as the original one denotes the relative commercial and service activity in the original sectors.

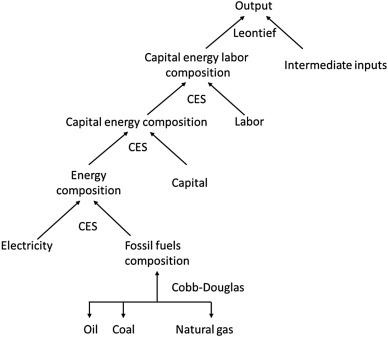

The models original version was employed by the U.S. governmental agencies to evaluate the impacts of various policies (Miller and Wei, 2010 and Rose and Wei, 2011 ). Here, the production module specifies the production activity in each sector. The production function is Cobb-Douglas, and the inputs in each sector include labor, capital, energy and other intermediate inputs, following a five-level nested constant elasticity of substitution (CES) function, as shown in Fig. 1 . Because energy consumption is sensitive, in some sense, to capital investment in China, reducing energy consumption is closely related to the types of capital investment. Therefore, in this model, the energy input changes with capital input, which accompanies a substitution for labor. The substitution elasticity in this model is drawn from Ma et al. (2009) .

|

|

|

Fig. 1. Nested production function. |

In the construction of ecologic civilization, the priorities are making the governments work and function better. In this study, we consider economic growth, social progress, environmental protection, technology and other developmental factors, combined with historic data of the national economy, population, energy utilization and industrial development, to estimate and simulate the peaking scenarios and policy combinations (Munasinghe et al., 1994 ). Furthermore, the scenarios implemented abide by the following principles: reach all of the peaks as early as possible; control coal consumption; make best efforts to realize the synergy of pollution control and CO2 emissions control and achieve all of the targets with affordable economic costs (Hotelling, 1931 , Hartwick, 1977 , Kraft and Kraft, 1978 , Wang et al., 2011 and WB (World Bank), 2013 ).

Based on the above-described principles, the thirteen chosen policies are depicted in Table 2 as follows: the energy policy group, including energy structure adjustments and energy intensities depicted as S1, S2, S3, and INTEN; the import control policy, relating to the impacts of fossil fuel import controls on demand structures, depicted as IMPOR; the supply side control group, focusing on the impacts of carbon taxes (environmental taxes) on the sectors, listed as TAX10, TAX100, TAX10RECLI, TAX10RECLR, TAX100RECLI, and TAX100RECLR; and the demand side control group, focusing on the impact of adjusting the ratios of investments and consumption on total energy demands, listed as INVE5 and INVE13.

| Policy code | Policy name | Policy explanation |

|---|---|---|

| S1 | High oil energy structure | In 2050, oil takes the highest position in total energy consumption. This policy assumes a 2013 start date |

| S2 | High coal | In 2050, coal takes the highest position in total energy consumption. This policy assumes a 2013 start date |

| S3 | High non-fossil energy structure | In 2050, non-fossil fuels take the highest position in total energy consumption. This policy assumes a 2013 start date |

| INTEN | Energy intensity | Lower the energy intensity as planned by the center government. This policy assumes a 2011 start date |

| IMPOR | Import control | Control the imported energy portfolio to a safe level. This policy assumes a 2013 start date |

| TAX10 | Carbon tax 10a | Levy CN¥10 on each ton of CO2 emissions from all industries. This policy assumes a 2014 start date |

| TAX100 | Carbon tax 100 | Levy CN¥100 on each ton of CO2 emissions from all industries. This policy assumes a 2014 start date |

| INVE5 | Investment 5%b | Set the proportion of investment in GDP at 5% in 2050. This policy assumes 2013 as the start year by linear annual change |

| INVE13 | Investment 13 | Set the consumption annual change rate at the 2012–2013 rate and assume 2013 as the start year |

| TAX10RECLI | Carbon tax 10 + subsidize industries | Levy CN¥10 on each ton of CO2 emissions from all industries and subsidize the industries by reducing other taxes. This policy assumes 2014 as the start year |

| TAX10RECLR | Carbon tax 10 + subsidize households | Levy CN¥10 on each ton of CO2 emissions from all industries and subsidize all households by reducing their income tax. This policy assumes 2014 as the start year |

| TAX100RECLI | Carbon tax 100 + subsidize industries | Levy CN¥100 on each ton of CO2 emissions from all industries and subsidize the industries by reducing their other taxes. This policy assumes 2014 as the start year |

| TAX100RECLR | Carbon tax 100 + subsidize households | Levy CN¥100 on each ton of CO2 emissions from all industries and subsidize all households by reducing their income tax. This policy assumes 2014 as the start year |

a. Tax rate of CN¥10 is set by taking the study of Fiscal Science Institute as reference (Su, 2013 ); the rate of CN¥100 is also set for comparison.

b. The investment proportion in GDP is set based on the number of developed countries. Considering the change rate in 2012–2013 is decreasing, this decreasing rate is taking as one scenario.

The taxes impact the producing costs and the factor prices. Then in a complete market, for a given output, producers decide the combination of inputs based on minimum costs. The production activity is presented as below (detailed equations see SDSSGCAS (2014) ):

|

|

( 1) |

|

|

( 2) |

Where is the demand of sector j on factor i ; is the corresponding factor price; is the total cost of sector j ; is the direct consumption coefficient; is the total output of sector j ; and t is the tax rate. The demands of sector j for labor, capital, and energy are then determined.

Similarly, the consumption activity function maximizes utility by combining commodities under the budget constraint, as shown in Equations (3) and (4) :

|

|

( 3) |

|

|

( 4) |

Where is the consumer demand for commodity i ; is the slope coefficient; and M is the total budget of consumers.

3. Simulation results and analysis

3.1. Peaks and peaking times of CO2 emissions, coal consumption, and PM2.5

The above-described policies were implemented individually as were their different combinations for a total of 188 different scenarios. Obviously, under this multitude of scenarios, CO2 emissions in China will vary dramatically. Without strong fossil fuel reduction measures, adjusting economic policies and implementing market measures, such as changing investment ratios and carbon taxes, will cause CO2 emissions to decrease at a slow rate. In contrast, if strong measures are taken to adjust the energy structures, then CO2 emissions in 2030 will be 15.8–21 Gt, or 11.3%–33.3% less than the reference scenario.

Effectively reducing the energy intensity along with adjusting the energy structure, the national CO2 emissions will be 10.7 Gt in 2050, which is equal to the level in 2015. Under these strengthened emission reduction scenarios, fossil fuel consumption will also be effectively controlled, and the total coal consumption will reach its peak or plateau at 3.3 Gt of coal equivalent in 2024. Peaks of different criteria under the various policy combinations are shown in Table 3 .

| Criteria | Unit | Peak | Peaking time range | Accumulated amount (2013–peaking time)a | Policy combination |

|---|---|---|---|---|---|

| CO2 emissions | 109 t | 11.1–15.6 | 2030–2047 | 185.6–452.1 | S3 + TAX100; S1 + INVE5 + INTEN + TAX10 |

| Coal consumption | 109 tce | 3.3–4.6 | 2024–2045 | 369–1,247 | S3 + INTEN + TAX100; S2 + INVE5 + INTEN + TAX10 |

| Energy consumption | 109 tce | 5.1–6.3 | 2029–2047 | 82.3–174.7 | S2 + INVE5 + INTEN + TAX10; S3 + INTEN + TAX100 |

| PM2.5 | 106 t | 9.0–14.3 | 2025b | 110.3–114.8 | S3 + INTEN + TAX100; S3 + INVE5 + TAX10 |

| Total CO2 emissions of energy intensity sectors | 106 t CO2 | 475.2–4,832.2 | 2028–2034 | 7.0–8.1 | S2 + INVE5 + INTEN + TAX10; S3 + INTEN + TAX100 |

| Population | billion | 1.47–1.51 | 2031–2046 | – | Separate two-child policy; full liberalization of two-child policy |

a. Denotes the time range when peaks take place in different policy combination scenarios.

b. PM2.5 peaks exist only in policy combinations with S3, and all the peaking times are in 2025. The emissions are calculated based on the consumptions of fossil fuels, including combustion and industrial process. The emission factors of CO2 are from IPCC (2006) and the emission factors of other pollutants are from Akimoto (1994) and Huang et al. (2011) .

Simultaneously adjusting the energy structure and employing energy intensity measures transfers the primary emitters from energy intensive sectors to non-energy intensive sectors. Combining high non-fossil fuel utilization, decreasing energy intensity and levying CN¥100 carbon tax (S3 + INTEN + TAX100) are the most effective strategies for reducing the national CO2 emissions and achieving the earliest peaking time of total CO2 emissions. But under this scenario, the energy intensive sectors' CO2 emission peak occurs in 2032. In contrast, lowering the investment ratio, decreasing energy intensity and levying CN¥10 of carbon tax in a high coal scenario (S2 + INVE5 + INTEN + TAX10), will result in the last total national CO2 emission peaking time, but the peaks of energy intensive sectors will be lowered and their peaking time will also be advanced to 2031. In other words, adjusting the energy structure and decreasing energy intensity, to some extent, can realize the economic growth decoupled from fossil fuel consumption and carbon emissions in China.

The energy-intensive sectors reach CO2 emission peaks at different times based on the demands involved in the process of industrialization and urbanization. With the combination of high non-fossil, decreasing energy intensity and levying heavy carbon tax (S3 + INTEN + TAX100), the energy-intensive sectors will reach their CO2 emission peaks in 2019–2026, as shown in Table 4 . Because most of the policies target coal reduction, the industry of mining and washing of coal reaches its emission peak first, in 2019. Second, the electricity and heat production and supply industry will reach its peak in 2024, representing the results of reconfiguring the energy structure. The metal manufacturing and processing industry and the non-metallic mineral products manufacturing industry will reach their emission peaks in 2026, which coincides with the process of urbanization and industrialization. In regard to the petroleum processing, coking, and nuclear fuel processing chemical industry and the other chemical industry, because many of their products are used as materials and intermediate inputs in other industries, these two industries will peak in 2040. As a whole, energy intensive sectors peak in 2029.

| CO2 emissions (106 t) | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 |

|---|---|---|---|---|---|---|---|---|

| Mining and washing of coal | 284.7 | 283.9 | 281.1 | 278.9 | 270.3 | 266.9 | 259.2 | 254.0 |

| Mining of metal ores | 5.4 | 5.5 | 5.5 | 5.5 | 5.4 | 5.4 | 5.4 | 5.3 |

| Mining and processing of nonmetal ores and other ores | 9.7 | 9.7 | 9.6 | 9.5 | 9.4 | 9.3 | 9.1 | 9.0 |

| Paper manufacturing, printing, and manufacturing of articles for culture, education and sport activity | 94.3 | 95.4 | 97.0 | 98.1 | 98.6 | 98.8 | 98.1 | 97.5 |

| Non-metallic mineral products manufacturing | 550.9 | 570.5 | 586.8 | 599.2 | 608.3 | 614.4 | 618.0 | 620.1 |

| Metal manufacturing and processing | 754.2 | 781.4 | 803.5 | 819.7 | 830.7 | 836.9 | 839.3 | 839.4 |

| Electricity and heat production and supply | 68.4 | 71.0 | 73.0 | 74.5 | 75.3 | 75.5 | 75.4 | 75.2 |

| Petroleum processing, coking, and nuclear fuel processing | 1,803.1 | 1,894.4 | 1,976.8 | 2,047.6 | 2,107.3 | 2,156.7 | 2,198.5 | 2,236.5 |

| Chemical industry | 616.3 | 645.8 | 672.1 | 694.5 | 712.9 | 727.8 | 740.0 | 751.0 |

| Total | 4,186.9 | 4,357.6 | 4,505.4 | 4,627.5 | 4,718.3 | 4,791.7 | 4,843.1 | 4,887.9 |

3.2. Synergetic effects on other pollutants

Currently, in China, the source of severe air pollution, PM2.5, comes mainly from coal combustion, vehicle exhaust and other emissions from fossil fuels. Therefore, implementing policies that include a transformation of economic development, an adjustment of the energy structure, and a reduction of CO2 emissions are synergetic to the reduction of PM2.5 and other related emissions.

Although the quantitative relationship between the emission amounts of these pollutants and the concentrations of PM2.5 or PM10 are unclear, implementing a combination of policies that include high non-fossil fuel utilization, a decrease of energy intensity and the imposition of a carbon tax (E3 + INTEN + TAX100), effectively controls emission amounts of the main pollutants, and PM2.5 can peak in 2025.1 The emissions of other pollutants are shown in Table 5 .

| Emissions | NOx | SO2 | VOCs | PM2.5 | PM10 | CO | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2030 | 2050 | 2030 | 2050 | 2030 | 2050 | 2030 | 2050 | 2030 | 2050 | 2030 | 2050 | |

| Reference scenario | 41.24 | 66.60 | 106.27 | 170.60 | 1.35 | 2.16 | 20.64 | 33.75 | 54.69 | 89.30 | 66.85 | 107.67 |

| Total | 19.69 | 16.41 | 49.88 | 39.58 | 0.51 | 0.44 | 9.21 | 6.81 | 24.27 | 17.71 | 30.58 | 22.40 |

| From coal combustion | 15.91 | 11.49 | 42.59 | 30.59 | 0.41 | 0.30 | 8.99 | 6.52 | 24.02 | 17.38 | 30.02 | 21.55 |

| From diesel combustion | 2.83 | 3.49 | 5.91 | 7.29 | 0.04 | 0.05 | 0.15 | 0.18 | 0.15 | 0.18 | 0.18 | 0.22 |

| From fuel oil combustion | 0.41 | 0.50 | 1.38 | 1.71 | 0.01 | 0.01 | 0.05 | 0.06 | 0.07 | 0.09 | 0.04 | 0.05 |

| From natural gas combustion | 0.54 | 0.93 | – | – | 0.05 | 0.08 | 0.03 | 0.05 | 0.03 | 0.05 | 0.34 | 0.58 |

Unfortunately, the results also indicate that even by the year 2050, the total emission amounts of PM2.5 will still be greater than 2012. Therefore, to realize the national air quality control target, the above policy combinations are far from enough and more strict measures are required. Improved synergetic effects will be achieved with detailed regional and sectorial measures based on the action plan for the control of air pollution.

3.3. Economic impacts of different peaking times

From a long-term view, proper policies and measures to reduce CO2 emissions are cost-effective; however, from a short-term view, there are significant economic costs. The results are depicted in Table 6 .

| Target | CO2 emission peaking time | CO2 emission peak (109 t) | PM2.5 emission peaking time | PM2.5 emission peak (106 t) | Policy combination | Time range of negative GDP impacts | Average annual GDP loss (%) | Time range of negative employment impacts | Average annual employment loss (%) |

|---|---|---|---|---|---|---|---|---|---|

| CO2 emissions peak as early as possible | 2025 | 11.8 | 2021 | 8.4 | S3 + INTEN + TAX100 | 2013–2033 | −5.92 | 2013–2028 | −8.23 |

| PM2.5 emissions peak as early as possible | 2030 | 13.5 | 2025 | 9.0 | S3 + INTEN + TAX10 | 2013–2022 | −2.96 | 2013–2020 | −3.58 |

| Smallest average annual GDP loss | 2032 | 12.2 | 2027 | 10.5 | S3 + INTEN + TAX100 | 2013–2024 | −3.57 | 2013–2022 | −5.22 |

| Smallest average annual employment loss | 2045 | 15.6 | 2029 | 14.3 | S3 + INTEN + TAX100RECLI | 2013–2024 | −4.83 | 2013–2020 | −3.37 |

| Smallest accumulated CO2 emissions per capita (2005–2050) | 2030 | 12.2 | 2028 | 10.5 | S3 + INTEN + TAX100 + Full liberalization of two-child policy | 2013–2024 | −3.72 | 2013–2023 | −5.57 |

Note: In the policy combinations, IMPOR is not considered here. If the IMPOR policy is factored in, the peaking time will be postponed by 1–2 years, and the emissions will stay the same.

After reviewing the policy combinations that can bring emissions to a peak, the scenarios of the lowest and highest emission cuts were examined. In regard to the highest emission cuts, the combination of policies including S3 + INVE5 + INTEN + TAX10 was examined. Before 2030, the average annual GDP loss is 3.92% compared to reference scenario, and the impact on GDP will not be positive until 2032. This scenario involves the following four factors: changing the investment ratio, reducing the energy intensity, levying CN¥10 of carbon taxes, utilizing a high non-fossil fuel scenario.

In regard to the scenario of the highest emission cuts, the combination of policies including S3 + INTEN + TAX100 was examined. This combination will bring the average annual GDP loss down to 3.58% before 2024, and the impact on GDP will be positive in 2025. This scenario involves the following three factors: reducing energy intensity, levying CN¥100 of carbon tax, utilizing a high non-fossil fuel scenario.

Furthermore, a sensitivity analysis on the economic impacts of policy combinations was reviewed. Using the peaking time of S3 + INTEN + TAX100 in 2030 as the base, we found that when the peaking time is controlled by decreasing the energy intensity and the other policies remain unchanged, each year before 2030, the annual average GDP will be 2.74% higher than the reference scenario. Moreover, with a peaking time of 2025, the impact on GDP will stay negative until 2033, with an annual average GDP loss of 5.92%. Additionally, the employment loss is even larger. Before 2030, the annual average employment loss will be 8.23%.

If the energy structure adjustment policy is used to control the peaking time, with the same base of 2030, then for each year, the annual average GDP will be 2.81% higher than the reference scenario. If the peak occurs in 2025, then the annual average GDP loss will be 7.52%. Before 2030, the annual average employment loss will be 11.07%.

4. Conclusions

In this study, the different impacts of feasible policies and their combinations were analyzed. Next, the effects on emission amounts control and corresponding macro-economic impacts were calculated and compared. By simulating and analyzing these policies and measures, we hope to find pathways that realize sustainable development with the lowest costs and greatest benefits to the economy and the environment. The study found that the main emission peaks could be achieved in stages. In the next five to ten years, the coal consumption and emissions from energy intensive sectors will reach their peak; the industry structure will change and the energy conservation will be mainly achieved by this structural change. In the next ten to twenty years, major energy consumption and emissions will reach their peak. Under most scenarios, the feasible CO2 emissions will peak around 2030. Future development in China involves a coexistence of opportunities and challenges, and the development transformation and energy structure adjustment are vital to achieving emission peaks at the proper time. Policy changes and suggestions for Chinas future decision-making are presented below.

First, adjusting the energy structure and decreasing the energy intensity are the most important measures in establishing emission peaks and realizing sustainable development. Carbon taxes and other market-based instruments are supplemental. In the simulations, we found that CO2 emission peaks can be achieved if the two policies of energy structure and energy intensity are implemented simultaneously. Although an analysis of the interchanges between the policies was outside the scope of this study, after analyzing the marginal reduction costs of single policies and their economic impacts, it is reasonable to assume that in five to ten years the energy structure can implement the high-coal scenarios. After economic development and disposable personal income increase, the energy structure could then be adjusted to the high non-fossil fuel scenario, to strengthen the utility of non-fossil fuels and further reduce the total energy consumption and related emissions.

Second, the peaking time is determined by the composite costs. If the peaks are expected before 2030 not only are the domestic economic development and employment levels impacted but also the global social welfare will be affected.

Different policy combinations can control emission peaks and peaking times; however, the price of the policy mix should be considered. Although Sterns report mentioned that only 1% of the global GDP is enough to control the temperature increase by 2 °C, the unique resources and economic structure in China result in a substantial price for achieving the peaks early. In regard to Chinas economic costs, the simulation shows that a proper CO2 emission peaking time is approximately 2030. Considering the international pressure to reduce emissions and meet domestic air quality control targets, it is prudent to implement more strict measures on the energy structure and intensity to bring about emission peaks earlier.

Third, to control PM2.5 emissions and other pollutants, more strict and targeted measures are needed. Based on the proceeding analysis, the method entitled “adjusting energy structure, reducing energy intensity and levying carbon tax” is an effective combination for controlling CO2 emissions, as well as PM2.5. With this combination, the total amount of PM2.5 peaks in 2025, which is far from the national target of being qualified for the standard II in 2030, and does not adequately address the urgent fog and haze issues. Therefore, to tackle the complex air pollutant PM2.5 more effective and efficient methods are needed.

Clearly, to achieve the desired peaks, China must develop a comprehensive policy, including plans and roadmaps, targets, pathways, corresponding technology cluster innovation and supporting finances and incentives. Chinas New Normal and ecological civilization both bring more challenges for the transformation of the economy, energy use, investment, and consumption as well as institutional arrangements. Also, impacts on the economic growth should be systematically considered.

CO2 and other pollutant emission peaks are entry points to develop green industries and sustainable development. From an institutional perspective, controlling the peaks and peaking times also presents challenges. Through a reform of the administrative system, China can achieve the goals of strengthening multiple corporations, reducing the overlap of functions, and realizing the integrated management of energy, resources, and climate change, and then finally, achieving the synergy of multiple scales, dimensions, levels and regions for low carbon development.

Acknowledgements

This work was funded by the National Natural Fund of China (71173206 ), and the Strategic Priority Research Program — Climate Change: Carbon Budget and Related Issues of the Chinese Academy of Sciences (XDA05150300 ).

References

- Akimoto, 1994 H. Akimoto; Distribution of SO2 , NOx and CO2 emissions from fuel combustion and industrial activities in Asia with 1*1 resolution ; Atmos. Environ., 2 (2) (1994), pp. 213–225

- Hartwick, 1977 J.M. Hartwick; Intergenerational equity and the investing of rents from exhaustible resources; Am. Econ. Rev., 67 (5) (1977), pp. 972–974

- Hotelling, 1931 H. Hotelling; The economics of exhaustible resources; J. Political Econ., 39 (2) (1931), pp. 137–175

- Huang et al., 2011 C. Huang, C.-H. Chen, L. Li, et al.; Anthropogenic air pollutant emission characteristics in the Yangtze River Deltaregion, China; Acta Sci. Circumstantiae, 31 (9) (2011), pp. 1858–1871

- IPCC, 2006 IPCC; 2006 IPCC Guidelines for National Greenhouse Gas Inventories; (2006) (Washington)

- Kraft and Kraft, 1978 J. Kraft, A. Kraft; On the relationship between energy and GNP; J. Energy Dev., 3 (1978), pp. 401–403

- Ma et al., 2009 H. Ma, L. Oxley, J. Gibson; Substitution possibilities and determinants of energy intensity for China; Energy Policy, 37 (5) (2009), pp. 1793–1804

- Miller and Wei, 2010 S. Miller, D. Wei; The Economic Impact of the Michigan Climate Change Action Plan on the States Economy; Report to the Michigan Department of Environmental Quality The Center for Climate Strategies, Washington, DC (2010)

- Munasinghe et al., 1994 M. Munasinghe, J.A. McNeely, A. Schwab, et al.; Protected Area Economics and Policy: Linking Conservation and Sustainable Development; World Bank, Washington, DC (1994)

- NBSC (National Bureau of Statistic of China), 2009 NBSC (National Bureau of Statistic of China); Input–Output Tables of China; (2009) ISBN 978-7-5037-5695-5/F. 2835, Beijing (in Chinese)

- Rose and Wei, 2011 A. Rose, D. Wei; Regional macroeconomic assessment of the Pennsylvania climate action plan; Regional Sci. Policy Pract., 3 (4) (2011), pp. 357–379

- SDSSGCAS (Sustainable Development Strategy Study Group of the Chinese Academy of Sciences), 2014 SDSSGCAS (Sustainable Development Strategy Study Group of the Chinese Academy of Sciences); China Sustainable Development Report 2014: Building Institutions for Ecological Civilization; Science Press (2014) Beijing (in Chinese)

- Su, 2013 M. Su; Low carbon calls tax reform; China Econ. Informatiz., 22 (2013), pp. 44–45 (in Chinese)

- Wang et al., 2011 K. Wang, L.-L. Zou, J. Guo, et al.; Carbon emission patterns in different income countries; Int. J. Energy Environ., 2 (3) (2011), pp. 447–462

- WB (World Bank), 2013 WB (World Bank); Country and Region Specific Forecasts and Data; (2013) Accessed http://www.worldbank.org/en/publication/global-economic-prospects/data

Notes

1. In this study, the emissions of pollutants are calculated according to the average emission factors of fossil fuels. The emission factors are from Akimoto (1994) .

Document information

Published on 15/05/17

Submitted on 15/05/17

Licence: Other

Share this document

Keywords

claim authorship

Are you one of the authors of this document?