Abstract

South Africas Renewable Energy Independent Power Producer Procurement Program has run four competitive tenders/auctions since 2011, which have seen US$19 billion in private investment, and electricity prices of wind power falling by 46% and solar PV electricity prices by 71%, in nominal terms. Competitive tenders were introduced after an unsuccessful attempt to implement feed-in tariffs. The tenders incorporated standard, nonnegotiable contract documents, including 20-year Power Purchase Agreements and an Implementation Agreement whereby the Government of South Africa back-stops IPP payments by the national utility, Eskom. All of these projects have reached financial close to date and some are already delivering power to the grid. The financing success has been due in part to the requirements for commercial banks to undertake a thorough due diligence of projects prior to bids being offered. The details of the policy package described may be useful for other policy makers in countries developing policies for renewable energy deployment.

Introduction

Costs of renewable energy technologies have fallen during recent years. The cost reductions are the result of many different factors, some related to technologies, others to finance, national institutional development, and increased competition. These developments would not have been possible without generous supporting policies in some pioneering countries, as suggested by Wene [1].

Developments in different countries may vary significantly depending on policy, legislation and regulatory frameworks, procurement practices, and market conditions. There are significant opportunities for learning lessons from countries that are achieving price reductions [2]. South Africa offers an interesting example of a renewable energy auctioning system that is attracting significant investment at highly competitive prices. The data and analysis in this article draw, in part, from an earlier study by Eberhard et al. [3] and have been updated with the latest data extracted from the South African Department of Energys Independent Power Producer Office.

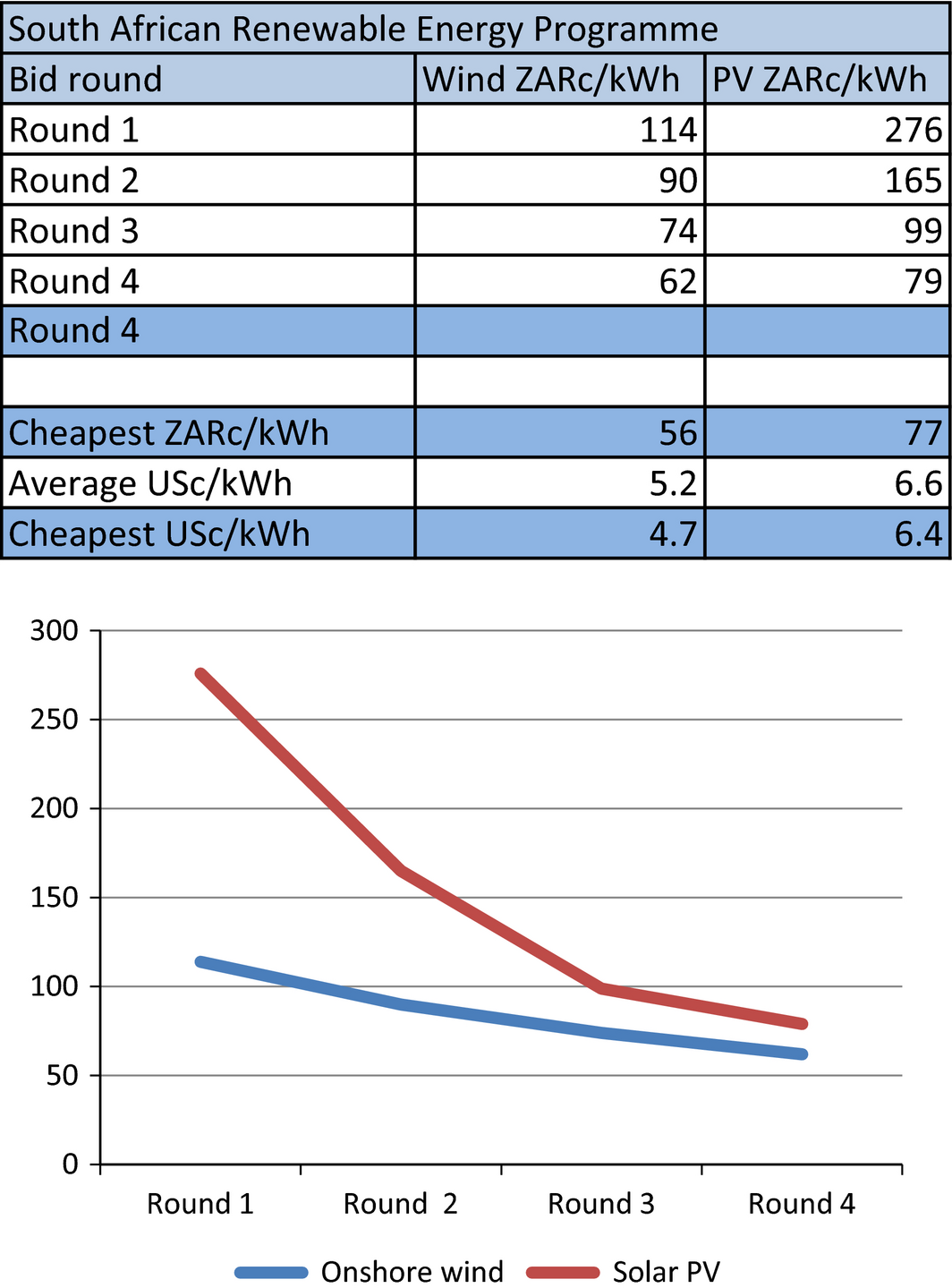

The latest grid-connected renewable energy auctions in South Africa have seen prices fall to among the lowest in the world with solar PV prices as low as USc 6.4/kWh and the cheapest wind at USc 4.7/kWh.1 Over four bid rounds, between 2012 and 2015, wind energy has fallen by 46% and solar PV by 71% (in nominal, local currency terms) (Fig. 1).

|

|

|

Figure 1. Average nominal bid prices in South Africas renewable energy IPP program (ZARc/kWh). Source: Authors’ compilation based on data provided by South Africas DOE IPP Office. |

South Africa occupies a central position in the global debate regarding the most effective policy instruments to accelerate and sustain private investment in renewable energy.

To date, a total of 92 projects have been contracted and private sector investment totaling US$19 billion has been committed for projects totaling 6327 megawatt (MW). There have also been notable economic development commitments in the form of local manufacture, employment creation, black economic empowerment, and community development [4]. Important lessons can be learned for both South Africa and other emerging markets contemplating investments in renewables and other critical infrastructure investments [3].

From REFIT to REIPPPP

A REFIT policy was approved in 2009 by the national energy regulator of South Africa, NERSA. Tariffs were designed to cover generation costs plus a real, after tax return on equity of 17% that would be fully indexed for inflation. Initial published feed-in tariffs were generally regarded as generous by developers – 15.6 USc/kWh for wind, 26 USc/kWh for solar PV, and 49 USc/kWh for concentrated solar (troughs, with 6 h storage).2 But considerable uncertainty about the nature of the procurement and licensing process remained. And the national utility, Eskom was less than enthusiastic in fully supporting the REFIT program by concluding power purchase agreements and interconnection agreements.

In March 2011, NERSA introduced a new level of uncertainty with a surprise release of a consultation paper calling for lower feed-in tariffs, arguing that a number of parameters, such as exchange rates and the cost of debt had changed. The new tariffs were 25% lower for wind, 13% lower for concentrated solar, and 41% lower for photovoltaic. Moreover, the capital component of the tariffs would no longer be fully indexed for inflation. Importantly, in its revised financial assumptions, NERSA did not change the required real return for equity investors of 17% [3].

More policy and regulatory uncertainty was to come. Already concerned that NERSAs FITs were still too high, the Department of Energy and National Treasury commissioned the legal opinion that concluded that the feed-in tariffs amounted to noncompetitive procurement, and were therefore prohibited by the governments public finance and procurement regulations. The Department of Energy and National Treasury then took the lead on a reconsideration of the governments approach. The fundamental goal of achieving large-scale renewable energy projects with private developers and financiers remained the same. However, the structure of the transactions, including the feed-in tariffs, was to change significantly.

A series of informal consultations were held with developers, lawyers, and financial institutions throughout the first half of 2011. These meetings proved to be extremely important in terms of allaying market concerns resulting from the earlier REFIT process and providing informal feedback from the private sector on design, legal, and technology issues.

In August 2011, the Department of Energy (DOE) announced that a competitive bidding process for renewable energy would be launched, known as the Renewable Energy Independent Power Procurement Program. Subsequently, NERSA officially terminated the REFITs. Not a single megawatt of power had been signed in the 2 years since the launch of the REFIT program as a practical procurement process was never implemented, and the required contracts were never negotiated or signed. The abandonment of feed-in tariffs was met with dismay by a number of renewable energy project developers that had secured sites and initiated resource measurements and environmental impact assessments. But, it was these early developers who would later benefit from the first round of competitive bidding under REIPPPP.

Competitive tenders

In August 2011, a Request for Proposals was issued, and the next month a compulsory bidders conference was held to address questions on bid requirements, documentation, power purchase agreements, etc. Some 300 organizations attended this conference. The REIPPPP program initially envisioned the procurement of 3625 MW of power over a maximum of five tender rounds. Another 100 MW was reserved for small projects below 5 MW that were procured in a separate small projects IPP program. Caps were set on the total capacity to be procured for individual technologies, the largest allocations were for wind and solar photovoltaics, with smaller amounts for concentrated solar, biomass, biogas, landfill gas, and hydro. The rationale for these caps was to limit the supply to be bid out, and therefore increased the level of competition among the different technologies and potential bidders.

The tenders for different technologies were held simultaneously. Interested parties could bid for more than one project and more than one technology. Projects had to be larger than 1 MW, and an upper limit was set on bids for different technologies, for example, 75 MW for a photovoltaic project, 100 MW for a concentrated solar project, and 140 MW for a wind project. Caps were also set on the price for each technology (at levels not dissimilar to NERSAs 2009 REFITs). Bids were due within 3 months of the release of the RFP, and financial close was to take place within 6 months after the announcement of preferred bidders.

The RPF was divided into three sections detailing: 1) general requirements, 2) qualification criteria, and 3) evaluation criteria. The documents also included a standard Power Purchase Agreement (PPA), an Implementation Agreement (IA), and a Direct Agreements (DA). The PPA was to be signed by the IPP and the Eskom, the off-taker. The PPAs specified that the transactions should be denominated in South Africa Rand and that contracts would have 20 year tenures from Commercial Operation Date (COD). The IAs were to be signed by the IPPs and the DOE and effectively provided a sovereign guarantee of payment to the IPPs, by requiring the DOE to make good on these payments in the event of an Eskom default. The IA also placed obligations on the IPP to deliver economic development targets. The DAs provided step-in rights for lenders in the event of default. The PPA, the IA and the DA were nonnegotiable contracts and were developed after an extensive review of global best practices and consultations with numerous public and private sector actors. Despite some bidder reservations regarding the lack of flexibility to negotiate the terms of the various agreements, the overall thoroughness and quality of the standard documents seemed to satisfy most of the bidders participating in the three rounds.

Bids were required to contain information on the project structure, legal qualifications, land, environmental, financial, technical, and economic development qualifications.

An important element of the design of the procurement process was to maximize the likelihood that winning bidders would able to execute the projects. Bidders had to submit bank letters indicating that the financing was locked-in highly unusual and basically a way to outsource due diligence to the banks. Effectively this meant that lenders took on a higher share of project development risk and this arrangement dealt with the biggest problem with auctions – the “low-balling” that results in deals not closing.

Further, the developers were expected to identify the sites and pay for early development costs at their own risk. A registration fee of US$1875 was due at the outset of the program. Bid bonds or guarantees had to be posted, equivalent to US$12,500 per megawatt of nameplate capacity of the proposed facilities, and the amount was doubled once preferred bidder status was announced. The guarantees are to be released once the projects come on line or if the bidder was unsuccessful after the RFP evaluation stage.

Project selection was based on a 70/30 split between price and economic development considerations. REIPPPP was able to adjust the normal government 90/10 split favoring price considerations in the procurement selection process. An exemption was obtained from the Public Preferential Procurement Framework Act in order to maximize economic development objectives.

The DOE IPP unit used a group of international and local experts to assess the bids. Many of these advisors had been involved in the initial design process. Given the scale of the investments, the competition anticipated, and the reputational risk identified, security, and confidentiality surrounding the evaluation process was extremely tight with 24-h voice and CCTV monitoring of the venue. Approximately 130–150 local and international advisors were used to develop the RFP and evaluate the bids in the first round, at a total cost of approximately US$10 million.

The bid evaluation involved a two-step process. First, bidders had to satisfy certain minimum threshold requirements in six areas: environment, land, commercial and legal, economic development, financial, and technical. For example, the environmental review examined approvals, while the land review looked at tenure, lease registration, and proof of land use applications. Commercial considerations included the project structure and the bidders’ acceptance of the Power Purchase Agreement. The financial review included standard templates used for data collection that were linked to a financial model used by the evaluators. The technical specifications were set for each of the technologies. For example, wind developers were required to provide 12 months of wind data for the designated site and an independently verified generation forecast. The economic development requirements, in particular, were complex and generated some confusion among bidders.

Bids that satisfied the threshold requirements then proceeded to the second step of evaluation, where bid prices counted for 70% of the total score, with the remaining 30% of the score given to a composite score covering job creation, local content, ownership, management control, preferential procurement, enterprise development, and socioeconomic development. Bidders were asked to provide two prices: one fully indexed for inflation and the other partially indexed, with the bidders initially allowed to determine the proportion that would be indexed. In subsequent rounds, floors and caps were instituted for the proportion that could be indexed. The bids were evaluated using a standard financial model.

In the first round, 53 bids for 2128 MW of power-generating capacity were received. Ultimately 28 preferred bidders were selected offering 1416 MW for a total investment of nearly US$6 billion. Successful bidders realized that not enough projects were ready to meet the bid qualification criteria and that all qualifying bids were thus likely to be awarded contracts. Bid prices in the first round were thus close to the price caps set in the tender documents. Major contractual agreements were signed on November 5, 2012, with most projects reaching full financial close shortly thereafter. Construction on all of these projects has commenced with the first project coming on line in November 2013.

A second round of bidding was announced in November 2011. The total amount of power to be acquired was reduced, and other changes were made to tighten the procurement process and increase competition. Seventy-nine bids for 3233 MW were received in March 2012, and 19 bids were ultimately selected. Prices were more competitive, and bidders also offered better local content terms. Implementation, power purchase, and direct agreements were signed for all 19 projects in May 2013.

A third round of bidding commenced in May 2013, and again, the total capacity offered was restricted. In August 2013, 93 bids were received totaling 6023 MW. Seventeen preferred bidders were notified in October 2013 totaling 1456 MW. Prices fell further in round three. Local content again increased, and financial closure was expected in July 2014, but has been delayed a number of times because of uncertainties around Eskom transmission connections. A fourth round of bidding commenced in August 2014; 77 bids were received with 64 being compliant and 13 preferred bidders were announced in April 2015, totaling 1121 MW. Prices were so competitive that a further 13 projects were awarded totaling 1084.

Over the four bidding rounds, US$19 billion has been invested in 92 projects totaling 6327 MW.

Increased competition was no doubt the main driver for prices falling over the bidding rounds. But, there were other factors as well. International prices for renewable energy equipment have declined over the past few years due to a glut in manufacturing capacity, as well as ongoing innovation and economies of scale. REIPPPP was well positioned to capitalize on these global factors. Transaction costs were also lower in subsequent rounds, as many of the project sponsors and lenders became familiar with the REIPPPP tender specifications and process.

Now RE prices are reaching grid parity and there is the potential for other countries to explore how they can learn from the SA REIPPPP through lowering transaction costs and designing competitive tenders appropriate to local markets.

Conclusion

Over the past 4 years, South Africas Renewable Energy Independent Power Producer Procurement Program has delivered remarkable investment and price outcomes which offer lessons for other countries on the potential benefits of competitive tenders or auctions.

Conflict of interest

None declared.

Notes

- 1 Prices fully indexed with inflation. ZAR/USD exchange deteriorated from 8 to 12 over period.

- 2 These values are calculated at the exchange rate at the time of ZAR8/USD.

References

- Wene, C.-O., (2000). Experience Curves for Energy Technology Policy. OECD/IEA Paris. http://www.oecd-ilibrary.org/energy/experience-curves-for-energy-technology-policy_9789264182165-en

- IRENA. 2015. Renewable energy auctions: a guide to design. International Renewable Energy Agency, Vienna.

- Eberhard, A., J. Kolker, and J. Leigland. 2014. South Africas renewable energy IPP procurement programme: success factors and lessons. Public Private Infrastructure Advisory Facility, World Bank, Washington, DC.

- Baker, L., and H. L. Wlokas. 2015. South Africas renewable energy procurement: a new frontier? Energy Research Centre. University of Cape Town, Cape Town, South Africa.

Document information

Published on 01/06/17

Submitted on 01/06/17

Licence: Other

Share this document

Keywords

claim authorship

Are you one of the authors of this document?