m (Scipediacontent moved page Draft Content 892099364 to Ji-Feng et al 2015a) |

|||

| Line 2: | Line 2: | ||

Based on the survey of international emissions trading system (ETS) and quantitative analysis, policy suggestions on establishing a carbon ETS in China are presented in this study. Sectors sensitive to carbon prices, e.g., the power generation sector and the iron and steel industry, are given priority to be covered by the ETS. Interregional carbon trading should be carried out as early as possible. The cap of the ETS should be based on China’s carbon intensity reduction target with the floor carbon price for the market being set in the beginning. Suggestions on the infrastructure of ETS are also proposed, including the national wide carbon account registration system and the legislation to national measuring, reporting, verification system building. | Based on the survey of international emissions trading system (ETS) and quantitative analysis, policy suggestions on establishing a carbon ETS in China are presented in this study. Sectors sensitive to carbon prices, e.g., the power generation sector and the iron and steel industry, are given priority to be covered by the ETS. Interregional carbon trading should be carried out as early as possible. The cap of the ETS should be based on China’s carbon intensity reduction target with the floor carbon price for the market being set in the beginning. Suggestions on the infrastructure of ETS are also proposed, including the national wide carbon account registration system and the legislation to national measuring, reporting, verification system building. | ||

| − | |||

| − | |||

| − | |||

| − | |||

==Keywords== | ==Keywords== | ||

Latest revision as of 14:01, 17 May 2017

Abstract

Based on the survey of international emissions trading system (ETS) and quantitative analysis, policy suggestions on establishing a carbon ETS in China are presented in this study. Sectors sensitive to carbon prices, e.g., the power generation sector and the iron and steel industry, are given priority to be covered by the ETS. Interregional carbon trading should be carried out as early as possible. The cap of the ETS should be based on China’s carbon intensity reduction target with the floor carbon price for the market being set in the beginning. Suggestions on the infrastructure of ETS are also proposed, including the national wide carbon account registration system and the legislation to national measuring, reporting, verification system building.

Keywords

carbon trading system ; cap of allowance ; distribution of allowance ; carbon price ; infrastructure of carbon market

1. Introduction

In early 2011, the Chinese Government issued an outline of the 12th Five-Year Plan (2011–2015), which clearly indicated its intention to gradually establish a carbon emissions trading system (ETS). Two provinces and five cities (including rural areas) have already been selected for implementing a pilot ETS by 2013. By 2015, the ETS will be gradually expanded to encompass the whole country① . According to the 12th Five-Year Plan, the ETS establishment in China will be carried out step by step and become an increasingly important policy tool for the control of greenhouse gas (GHG) emissions and the promotion of low-carbon development in the future. To build such a market system, the principles have to be integrated in a roadmap to build a successful ETS, which will be defined by the central government firstly, which can then guide the pilot work and facilitate the nationwide carbon market in the future.

At present, eleven countries and regions around the world are operating ETS, three are well advanced in their ETS design and implementation plans, and seven other countries are considering or setting up plans for ETS implementation (Table 1 ). Some policy recommendations in this paper are based on the review of these international cases, in particular, the EU ETS, which is so far the largest and most effective in the world.

| Development stage | Region/Country | Starting |

|---|---|---|

| Operating | New South Wales, Australia | 2003 |

| EU ETS | 2005 | |

| Alberta, Canada | 2007 | |

| Switzerland | 2008 | |

| New Zealand | 2008 | |

| Regional Greenhouse Gas Initiative (RGGI), U.S. (including 10 north-eastern states) | 2009 | |

| Tokyo, Japan | 2010 | |

| Carbon Reduction Commitment (CRC), UK | 2010 | |

| Norway | 2005 | |

| Australia | 2012 | |

| Western Climate Initiative (including 11 states in the U.S. and Canada) | 2012 | |

| Planned | California, U.S.② | 2013 |

| Korea | 2015③ | |

| China | 2013/2015④ | |

| Early stage | American Clean Energy and Security Act of 2009 | Cancelled |

| Japan | ||

| Brazil | ||

| Ukraine, Russia, etc. | ||

| Chile | ||

| Turkey | ||

| Mexico |

Source: Hood [2010], and updated by author based on the latest public information

2. ETS: Fundamental concepts and importance to China

The ETS consists of market-based mechanisms that are used to trade CO2 emissions (and other GHGs). A government agency usually determines the scope of the market and sets a cap on the amount of allowed emissions. Emission permits of equal value are first allocated to market bodies, after which the liable entity can decide independently whether to reduce emissions or trade emission permits. After the completion of a trading period, the quantity of verified emissions must equal the quantity of allowances surrendered by the liable entity. In addition, the establishment of supporting systems such as measuring, reporting, verification (MRV) systems and trading platforms is also necessary in order to ensure successful operation of the system⑤ .

In order to reduce emissions, caps must be set at a lower level than the market’s “business as usual” level of emissions in order to ensure market scarcity and generate emissions reduction efforts. In an ETS, businesses that encounter abatement costs higher than the market permit price can purchase more permits in order to cover rather than reduce emissions, whereas enterprises for which it is cheaper to reduce emissions can sell their surplus emissions permits for a profit, thereby providing an incentive for emissions reduction. Therefore, as long as the emissions cap is not exceeded, the ETS market mechanism can exploit opportunities for low-cost emissions reduction and therefore minimize the overall cost of emissions abatement.

Economic reforms in China have already passed more than three decades since 1978. However, the reform of the pricing regime for factors of production (including labor, capital, and energy products, etc.) now faces great obstacles [ Fan , 2009 ]. The establishment of an ETS could affect and even disrupt the existing policy system, thereby accelerating policy reforms and achieving economic transformation. This can be demonstrated in the following two areas.

First, the introduction of an ETS is a major breakthrough in the policy system of energy saving and emissions reduction in China. An ETS is a highly market-oriented emissions reduction measure that can theoretically and empirically achieve emissions reduction targets at a lower cost relative to command and control policies, the latter being the dominant policies in China. This forms the basis and motivation for introducing emissions reduction policies in China at present. It became clear that after the 11th Five-Year Plan (2006–2010), the space for the implementation of command- and control-policies was getting smaller. Therefore, the introduction of an ETS under the 12th Five Five-Year Plan would provide a good opportunity and a good starting point for gradually phasing out former high-cost approaches and forming a GHG policy regime largely based on market-based oriented instruments, and therefore ensure the cost-effective achievement of energy saving and emissions reduction targets [ Guo and Hao , 2011 ].

Second, the ETS could become a core industrial policy and promote the strategic adjustment of China’s economic structure. An ETS introduces carbon pricing, and changes both the relative price between high- and low-carbon products and the relative price between high- and low-carbon processes in the industrial chain. As such it aims at encouraging consumers to purchase low-carbon products and also it guides investment toward low-carbon processes. This kind of push-pull effect can effectively incentivize the development of the entire low-carbon industry.

3. Policy recommendations for the construction of an ETS in China

At this starting stage, there is an urgent need for a market design plan that can effectively reduce energy saving and emissions reduction costs and successfully guide low-carbon consumption and low-carbon investment. Based on the review on existing carbon markets [ Hood , 2010 ] and the analyzed studies in this paper, we obtain policy recommendations for the establishment of an ETS in China.

3.1. Main principles for coverage definitions of the carbon market

Many factors must be considered when determining which sectors and businesses are to be introduced in the ETS; but during the initial developments, the main contradictions must be grasped in order to allow the carbon market to optimize its core strengths. Therefore, enterprises with both low and high emissions reduction costs should be included in the ETS. In theory, the wider the scope of emission sources in the ETS the better. However, considering that the transaction costs increase along with the broadening of the scope, ETS often includes only a few sectors and businesses [ Hood , 2010 ]. Initially, the ETS will feel its way forward step-by-step and during this stage its industrial scope must be determined with great caution. The largest ETS in the world at present, the EU ETS, includes the power sector as well as other industrial sectors, and it only covers about 45% of total CO2 emissions in Europe. The UK’s Carbon Reduction Commitment (CRC) scheme, the New South Wales Emission Scheme (NSW ETS) in Australia, and the Regional Greenhouse Gas Initiative (RGGI) in the U.S. are set up similarly. The only exception is the ETS in New Zealand, which attempts to cover all emission sources (Table 2 ).

| Key global ETS | Scope of sectors |

|---|---|

| NSW, Australia | Power sector |

| EU | Electricity + industry (large-scale emitters) |

| Alberta, Canada | Electricity + industry (large-scale emitters) |

| Switzerland | Power sector |

| New Zealand | All emission sources (except agriculture) |

| RGGI, USA (including 10 north-eastern states) | Power sector |

| Tokyo, Japan | Commercial buildings + industry (large-scale emitters) |

| CRC, UK | Organizations consuming more than 6,000 MW h |

| Norway | Electricity + industry (large-scale emitters) |

| WCI (11 states in U.S. and Canada) | In initial start-up period, electricity and large-scale emitters in industry (annual emissions > 25,000 t CO2 -eq) |

| California, U.S. | In initial start-up period, electricity and large-scale emitters in industry (annual emissions > 25,000 t CO2 -eq) |

Source: Hood [2010]

For the establishment of an ETS in China, the scope should initially be restricted to a limited range of businesses and sectors at the beginning. Regarding the selection of sectors that it should cover, this paper recommends two principles in the following.

3.1.1. Introduction of carbon-price sensitive sectors into the ETS

Opportunities for low-cost emissions reduction are not distributed evenly through the economy and society as a whole, and are often concentrated in a number of particular sectors. Efforts to locate such sectors and accordingly establish an ETS within a limited scope can be very effective. In general, carbon-price sensitive sectors often provide more opportunities for low-cost emissions reduction.

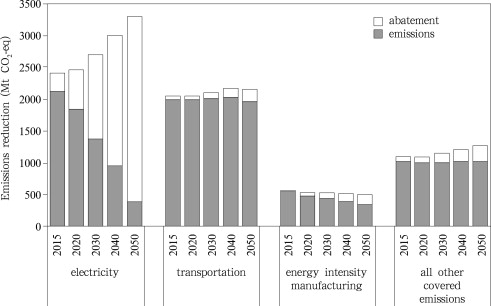

The U.S. Environmental Protection Agency (EPA) used a model to simulate the responses of different sectors to the introduction of an ETS. The results of the study (Fig. 1 ) show that when sectors such as power and transport enter the market simultaneously, the former, which is most sensitive to carbon prices, shows the greatest reduction in emissions while the transport sector reacts more slowly. Therefore, in 2010, the U.S. issued a plan for the establishment of an ETS centered on the power sector.

|

|

|

Figure 1. Sectoral emissions reduction of the emissions trading system (ETS) of the U.S. Clean Energy and Security Act of 2009 (H.R.2454) [ EPA , 2010 ] |

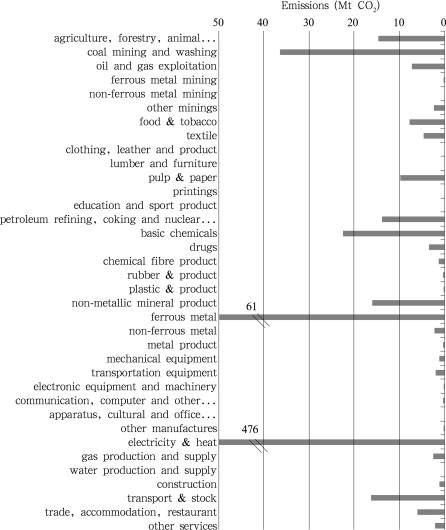

For this paper, the China State Information Center’s computable general-equilibrium model (SIC-GE) has been applied to analyze the short-term impact of carbon pricing at 100 RMB per ton CO2 . The detailed methods are shown in the report by Wang et al. [2011] . SIC-GE is a dynamic, large scale, national CGE model for China, which core modules are like the ORANI model [ Dixon et al. , 1982 ]. The dynamic mechanism is like the MONASH model [ Dixon and Rimmer , 2002 ], and have some special modules for labor market segmentation and price distortion [ Zhang and Li , 2010 ] according to China’s actual situation. The short-term emissions reduction in different sectors (compared to levels of 2007) is given in Figure 2 .

|

|

|

Figure 2. Emissions reduction of various industrial sectors in China in the ETS under the scenario of the carbon price at 100 RMB per ton CO2 |

The numbers, given in Figure 2 , show that the power sector is the most sensitive to carbon prices in China, after which other high-energy consumers such as the steel, coal mining and chemical industries also demonstrate relatively high levels of sensitivity. Therefore, these four sectors should be the first sectors to be included into an ETS.

3.1.2. Inter-provincial trade to clear differences in emissions abatement costs (EAC)

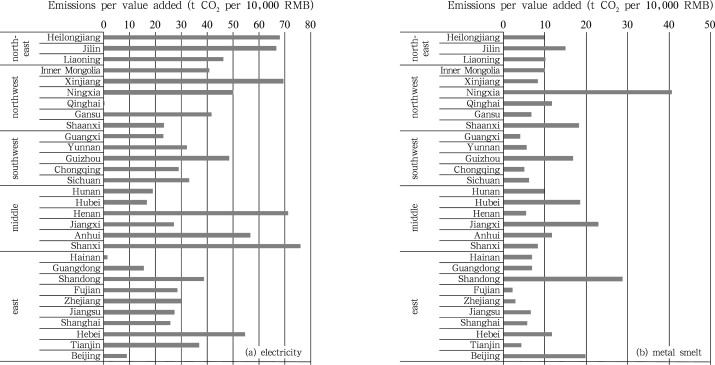

Under an ETS, theoretically, the greater the difference in EAC between liable entities in the market, the more effective it is at reducing overall EAC. Research results of SIC, which used provincial inputoutput tables from 2007 [ NBSC , 2011 ], show much higher sectoral carbon intensities in less-developed regions like western China than in developed regions of eastern China (Fig. 3 ). This demonstrates a significant difference in levels of technology and implies a huge gap in the potential for emissions reduction and its cost. Therefore, inter-provincial trading should be realized as soon as possible.

|

|

|

Figure 3. Comparison of the CO2 emissions per value added of major energy intensive industries (electricity and metal smelt) among provinces and municipalities in China |

3.2. Main principles for cap define and permit allocation

3.2.1. Future emissions cap in China should be tied to carbon intensity targets

Emissions cap directly reflects the effectiveness of an ETS at reducing emissions; determining too many allowances indicates that the market is not efficient to reduce emissions. In addition, emissions cap determines the scarcity of permits in the ETS, which directly affects carbon-price levels and the market’s effect on low-carbon consumers and investors. To a large extent it decides whether or not the ETS is able to work effectively as a production and investment policy tool.

China has already set an emissions reduction target of 40%–45% reduction in CO2 emissions per unit of GDP by 2020 compared to the 2005 level. The 12th Five-Year Plan also sets a binding target of 17% reduction in CO2 emissions (carbon intensity) per unit of GDP. Ma et al. [2009] and Garnaut et al. [2008] both emphasize that such targets won’t be achieved without large efforts, which means that the cap of carbon market, which is defined following national or provincial targets, could keep the scarcity of permits.

To be more specific, the calculation of emissions permits in an ETS according to intensity targets can be divided into three steps: the first step is to carry out economic development forecasts in certain regions according to a BAU (business as usual) design principle [ Ma et al. , 2009 ] and to transform carbon intensity targets into carbon emissions targets in absolute values; the second step is to estimate the share of total emissions that would constitute emissions from sectors covered by the ETS in a given region over the historical period (e.g., 3 years); finally, an emissions permits is calculated based on the results of the first two steps. This coupling process can be set up in a flexible manner based on the negotiation of the liable entities and government agencies, since its impact on the competitiveness of liable entities. This process and its underlying rules must be fully transparent in order to be conducive to the stable development of a carbon emissions market.

This kind of relative emissions reduction approach seems more suitable for the Chinese economic conditions, but it is different from the methods used by existing schemes such as the EU ETS, where future carbon market permits are set according to absolute quantities of carbon emissions in the past. The period from now until 2020 is a period of major strategic opportunities for China’s economic development. A good coordination between economic growth and GHG emissions mitigation is more important than only focusing on controlling GHG emissions.

3.2.2. Permit allocation choices: Organic combination of grandfathering and auctioning

Two factors should be considered when determining the initial distribution of emissions permits: first, a buffer period is required for businesses to consider carbon costs and adapt to ETS conditions; second, as all industrial sectors are developing rapidly in China and the scale of new production capacity is enormous, the relationship between existing and new production capacities should be coordinated appropriately to avoid economic distortions.

At present, two key methods of permits allocation — grandfathering and auctioning — are used around the world. The vast majority of emissions trading systems in developed nations have used grandfather clauses based on historical emissions to distribute permits freely during initial start-up phases in order to minimize their impact on the competitiveness of businesses. However, this does not suit Chinese economic conditions. In the EU, the application of the grandfather clause encouraged new traders to use high-emitting technology in order to obtain more emissions permits, which was inconsistent with the original intention of the ETS [ Ellerman , 2010 ]. This lesson is of particular importance to China considering that it is still in a stage of rapid development, with large increases in production capacity and many new businesses. Therefore, this paper recommends that emissions permits be allocated freely to existing production capacity units, after which permits should be reduced in a slow and stable manner; while permits should be auctioned to new production capacity units, in order to facilitate the use of low-carbon technologies. This kind of approach can lessen the short-term impact of the ETS on the competitiveness of existing businesses, while avoiding the use of technologies with high emissions intensity levels from new projects.

3.3. Main principles for carbon price management

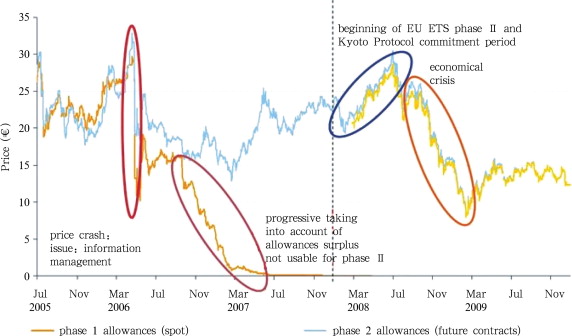

The success of an ETS in guiding low-carbon consumption and investment is dependent on whether or not carbon prices are set at a reasonable level, but by nature ETS implies carbon price fluctuations. Firstly, ETS differs from other commodity markets in that emissions caps for any year are determined in advance; so that any changes in demand are fully reflected in carbon price fluctuations. Also, other factors such as concerns regarding possible adverse effects of the ETS, overly optimistic economic forecasts and low estimations of the speed of technological progress often lead to exaggerated permit estimates. This can weaken the scarcity value of permits and cause carbon prices to fall or even collapse [ Webster , 2008 ]. During the initial phases of the EU ETS (Fig. 4 ), the ETS in Norway and the RGGI in the U.S., carbon price crashes were largely due to high levels of permits allocation. This is an important lesson to consider.

|

|

|

Figure 4. EU ETS permits prices fluctuation (2005–2009) (source: BlueNext.Ecx) |

In addition to carrying out more research to increase the accuracy of permit calculations, supplementary measures are often needed to avoid large-scale price fluctuations and resolve the issue of carbon price instability. At present, the methods used by the EU to stabilize carbon prices include several kinds of flexible mechanisms, such as the clean development mechanism (CDM) or the joint implementation (JI) that were established under the Kyoto Protocol; and flexible inter-period mechanisms in areas such as agreement durations, permit reserves and permit banking. In addition, there are also a number of simple and direct methods for setting upper and lower carbon price limits. The UK CRC market, the WCI in North America, and California ETS and the American Clean Energy and Security Act [ Hood , 2010 ] all set floor carbon prices. Compared with other methods, such direct approaches to the determination of minimum carbon price levels have a stronger impact on the market and can damage commercial efficiency in the short term. However, they can prevent excessively low carbon prices and stabilize expectations for investors and consumers in the future. Current Chinese economic conditions mean that design of a carbon offset mechanism is relatively difficult. Given the urgent need for a transformation of the approach to economic development in China, it is even more important to maintain an appropriate high carbon price level. Therefore, we recommend that during the initial start-up period of the ETS in China, we must first consider methods to set a minimum carbon price limit and integrate stock exchange market price limits in order to avoid excessive carbon-price fluctuations. For example, stock exchanges in China have set 10% as the maximum price variation within a single trading day. Stock price is determined by the market demand and supply as long as its price variation lies within the range from –10% to 10%. However, the price of a stock is fixed artificially at 10% or –10% if it goes too high or too low and cannot overpass this threshold in a trading day.

3.4. Essential infrastructures for carbon market building

3.4.1. Build national wide electronic carbon accounts registration system

In the EU ETS, the electronic carbon accounts registration system has been built for each member states from the start. Any liable entities in the market as well as other enterprises or individuals who want to enroll in carbon trading need to apply for an account in the registration system. In each account, the amount of owned permits and the authorized reported emissions will be recorded. The government monitors all accounts to manage the carbon market through the registration system.

For the past decade, the national registration systems of the EU ETS, which were not linked and integrated in one whole system, were managed by each member state. Since 2011, the emissions market has witnessed several incidents of allowances being stolen from national registries⑥ , which severely affected the credibility of the EU ETS and led to the downward trend in carbon prices. To solve the problem, EU is trying to link all registration systems of the member states, so as to build and manage an integrated registration system for the entire EU. With the lessons learned from the EU ETS, we suggest that, a nationwide integrated electronic registration system should be built in China as soon as possible, even if there are momentarily only five cities and two provinces starting to engage in the carbon market.

3.4.2. Step by step using laws and regulations to unify the scope and standards for carbon emissions measurements, reports and verification systems

Credible emissions permits are the foundation of trade as “standard goods” in an ETS. Two aspects contribute to the credibility of carbon emissions accounting: first, a real correspondence between emissions permits and the actual quantity of emissions; and second, the legal foundations. Therefore, we must establish a set of management systems for the measurement of emissions from emission sources, the submission of emissions reports to the government and the verification of the submitted reports (known as the MRV system). Emissions permits can only be based on emissions quantities that are authenticated by this system. In order to facilitate the longterm development of the ETS, we recommend that actions must be taken at the national level and as soon as possible in order to establish the legal and regulatory measures which are necessary to establish the standards, guidelines and detailed regulations of an MRV system. The reasons for this are threefold. First, although the ETS are currently being established in pilot regions, the ultimate target is to expand their coverage nationwide. The establishment of standardized MRV systems in pilot areas will benefit the future integration of the ETS across the country. Second, China is one of the world’s top producers of carbon emissions and its ETS promises to become the largest in the world. The establishment of a unified MRV system across the country and the creation of standardized emissions permits will benefit China’s future participation in global emissions trading markets and give it greater international credibility. Third, the establishment of an MRV system requires a large amount of specialized labor and long-term training of personnel. The technical standards and detailed regulations that are involved in the establishment of a unified MRV system are conducive to a highly efficient training of personnel.

When China issues unified standards for the establishment of an MRV system, all regions in the country will gradually establish MRV systems in time with the construction of the ETS. However, this will not be accomplished overnight — it should be a process of exploratory construction, progressive development and sustainable completion that is carried out in conjunction with the ETS. In the EU for example, the EU ETS established a series of MRV regulations before its initial implementation phase (2004/156/EC). During the first phase it went on to improve and expand regulations regarding the measurement and evaluation of emissions, and in 2007 formed a second set of MRV regulations (2007/589/EC). It is currently continuing to adjust regulations for the unified ETS that will be established in the EU in 2013.

Current statistics on carbon emissions in China are still relatively weak and are based on three key areas: first, the five-yearly formulation of national carbon emissions inventories; second, energy statistics; third, research on emissions measurement methods from CDM projects. In the future, efforts to establish MRV systems in pilot areas in China should build on the lessons learnt in these three areas and gradually establish an MRV system under the unified direction of state regulations.

3.4.3. Construction of an emissions trading platform to promote the gradual development of a carbon finance industry

Following the development of an ETS, a carbon finance industry will also gradually emerge. The definition of carbon finance industry can be very broad in scope and could include: the establishment of trading platforms dedicated to emissions trading; carbon securities companies creating derivatives based on emissions permits; and carbon fund companies specialized in carbon trading. The development of the carbon finance industry will allow financial markets to facilitate successful trading, price discovery and lower trading costs, increase the flexibility of emissions permit trading and clarify the results of the ETS with regard to emissions reduction. In addition, it will also promote the emergence and development of new forms of industry that focus on servicing low-carbon production and consumption. Given current conditions, we recommend using the construction of a carbon trading platform to spearhead the advancement of the carbon finance industry. In one respect, a carbon trading platform is fundamental to standardize the system of emissions permit trading and to regulate the operation of the carbon market. As such, it should be established in the initial start-up phase of the ETS. By contrast, the development of carbon securities companies and carbon fund companies should come later and should be developed only gradually after the ETS has been established and is operating normally. In addition, more or less all existing environmental exchanges in China participate in carbon trading and have accumulated a significant amount of experience for future domestic emissions trading. Environmental exchanges in China are developing quickly in successive phases. In 2008 there were only three: the Shanghai Environment Energy Exchange, the Beijing Environment Exchange, and the Tianjin Climate Exchange. In 2009 environmental exchanges had been established in a number of provinces, such as Zhejiang, Yunnan, Hubei, and Guangdong (two exchanges in Guangzhou and Shenzhen). In 2010 other provinces such as Shandong, Shanxi, and Sichuan have also started to plan for the development of similar trading platforms. Their work is still based primarily on CDM emissions trading and voluntary emissions trading. In the future, efforts must be made to prepare to adapt emissions permit trading, including training of specialized traders and the development of a carbon trading account system.

3.5. ETS coordination with other energy saving and emissions reduction policies

Although the establishment of an ETS is of great importance for the future of energy saving and emissions reduction efforts in China, it might not be the only policy needed. Both the pilot schemes that are being set up at present and the unified, nationwide ETS that will be established in the future must be well coordinated with other energy saving and emissions reduction policies. In one respect, the ETS can only cover a limited range of sectors and businesses. In order to cover a wider range of emission sources, other policies must also encourage emissions reduction. In addition, some other policies should be relaxed in order to prevent putting excessive pressure on companies during the initial start-up phase of the ETS. Thirdly, the market operating mechanism of the ETS must be carefully protected as it progressively develops and as more regulatory details emerge.

3.6. Launch training for specialized ETS personnel as soon as possible

One of the key elements of the establishment of an ETS is the training of specialized personnel. However, ETS specialists are extremely rare in China, which is due to two reasons: first, emissions trading is a newly emerging sector and still lacks a body of theory and knowledge; second, specialized personnel in the emissions trading sector must have inter-disciplinary knowledge in all disciplines involved, such as the environment, finance, law and management. Therefore, the training of specialized ETS staff must begin in the following three areas: first, theoretical and knowledge systems related to emissions trading must be developed in order to provide the foundation for training backgrounds; second, professional training schools and training organizations should be established to train specialized ETS staff; third, qualifications for ETS personnel should be strengthened to enable the ETS to operate in a normal and orderly way.

4. Concluding remarks

In this paper, we propose ten policy suggestions from six perspectives of building a carbon market in China during the 12th Five-Year period. The research is based on the survey of carbon markets worldwide and some quantitative analyses. The suggestions are mainly proposed from the economic point of view of facilitating carbon trading, building essential infrastructures, and training human capital. The suggestions will not restrict but strengthen the marketing features of a carbon market in China.

According to the schedule on carbon market building during the 12th Five-Year period, seven regional carbon market pilot projects will firstly be conducted from 2013 onward, and extended nationwide around 2015. During the process of regional pilot projects, the central government should publish the general directives to guide the regional pilots in the following areas: coverage of market, cap and allocation rules of permit, carbon price management, carbon account registration system, MRV, and training course, etc. The specialty of a regional market should also be encouraged in concrete regulations, considering the quite different seven pilot projects, which will bring experiences for the construction of a national carbon market in the future.

Acknowledgements

This research is supported by the National Basic Research Program of China (No. 2012CB955700 and 2010CB955501).

References

- Dixon and Rimmer, 2002 P.B. Dixon, M.T. Rimmer; Dynamic General Equilibrium Modeling for Forecasing and Policy, North-Holland (2002), p. 338

- Dixon et al., 1982 P.B. Dixon, B.R. Parmenter, J. Sutton, et al.; ORANI: A Multi-Sectoral Model of the Australian Economy, North-Holland (1982), p. 372

- Ellerman, 2010 D.A. Ellerman; Pricing Carbon, the European Emissions Trading Scheme, Cambridge University Press (2010), p. 390

- EPA, 2010 EPA (U.S. Environmental Protection Agency); Supplemental EPA analysis of the American clean energy and security act of 2009 H.R.2454 in the 111th Congress; Accessed (2010) http://www.epa.gov/climatechange/economics/pdfs/HR2454_supplement-alAnalysis.pdf

- Fan, 2009 G. Fan; Price reform of factors of production and the promotion of market competition; Study of Economic Theory (in Chinese) (1) (2009), pp. 3–5

- Garnaut et al., 2008 R. Garnaut, S. Howes, F. Jotzo, et al.; Emissions in the platinum age: The implications of rapid development for climate change mitigation; Oxford Review of Economic Policy24 (2008), pp. 377–401

- Guo and Hao, 2011 X.-G. Guo, Q.-J. Hao; Carbon trading market for energy saving and emission targets in China; China Environmental Protection Industry (in Chinese) (4) (2011), pp. 63–66

- Hood, 2010 C. Hood; Reviewing existing and proposed emissions trading systems; IEA information paper, 1929/31-37/33/61/50-55 (2010)

- Ma et al., 2009 X. Ma, J.-F. Li, Y.-X. Zhang; An important question before Copenhagen meeting — BAU scenario in the climate change study and international negotiation; International Economic Assessment (in Chinese), 6 (2009), pp. 5–8

- NBSC (National Bureau of Statistics China), 2011 NBSC (National Bureau of Statistics China); Regional Input-Output Table 2007 (in Chinese), China Statistical Press (2011), p. 430

- Wang et al., 2011 X. Wang, J.-F. Li, Y.-X. Zhang; Can China afford to commit to implementing effective carbon pricing policies?; The competitiveness impacts on China’s economy. Climate strategies report (in Chinese). (2011)

- Webster, 2008 M.D. Webster; Cost containment: A primer. Cap and trade: Contributions to the design of a U.S. greenhouse gas program; MIT Center for Energy and Environmental Policy Research (2008) Boston

- Zhang and Li, 2010 Y.-X. Zhang, J.-F. Li; Raising price of petroleum product, industrial subsidy and its impact on economic development in China; Reform (in Chinese) (8) (2010), pp. 49–57

Notes

①. http://news.hexun.com/2011-07-18/1315984.html

⑤. Following the introduction of EU ETS. Http://ec.europa.eu/environment/climate/emission/intex_en.htm

⑥. http://www.pointcarbon.com/aboutus/pressroom/pressreleases/1.1499620

Document information

Published on 15/05/17

Submitted on 15/05/17

Licence: Other

Share this document

Keywords

claim authorship

Are you one of the authors of this document?